Cover2go mobile technology innovations

ITWeb Mobile Payments, Johannesburg, South Africa -- Plunging headfirst into mobile, Cover2go, created by Metropolitan, is employing mobile technology innovations to distribute insurance to millions of un- and under-insured people. Announced today, Cover2go implemented Clickatell's Enterprise USSD solution to improve insurance access, advance sales efficiencies, and streamline business processes by leveraging the mobile phone. As a result, Cover2go has greatly reduced the cost of insurance and improved insurance accessibility in remote areas.

"Given South Africa's large cell phone penetration, it was imperative to develop a well thought out mobile distribution strategy because Cover2go is designed to reach people who fall outside of the gambit of traditional insurance models," said Cover2go's Raymond Africa, head of IT Infrastructure and Process. "We chose Clickatell because they have seen what works and what doesn't when deploying mobility strategies in our part of the world."

Now, using the Clickatell-powered USSD solution, customers can activate insurance vouchers via mobile by texting Cover2go's unique short-code, 120*C2GO# (120*2246#), therefore eliminating the need for a sales representative. Cover2go's "direct activation" allows consumers to simply enter the "voucher activation number," along with the necessary personal information, all from their mobile phone in a secure USSD session. Metropolitan Cover2go has also found tremendous benefits in leveraging mobile enrollment as a way of streamlining internal processes for accurate verification as well as automated data confirmation.

"Financial institutions, large and small, continue to be leading adopters of mobile and are successfully capturing new customers, satisfying existing ones, and fast creating new revenue streams as they move beyond the traditional means of commerce and communication. Companies--local and abroad--can learn a great deal from the deployment by Cover2go - a global leader in bringing the next wave of financial services to a largely underserved market," said Pieter de Villiers, CEO of Clickatell. "We're excited about the market growth ahead and our role in enabling financial services providers to remain relevant with their ever-increasing mobile customers as they introduce successful mobile banking and insurance products in developed and developing markets."

Four billion of the world's 6 billion people use a mobile phone today, and in developing markets, mobile is often the only technology available. It has been predicted that the mobile phone will change communities and their economic outlook, especially in developing parts of the world. Mobile phone penetration and use continues to skyrocket each year, growing even faster in Africa than many other places throughout the world.

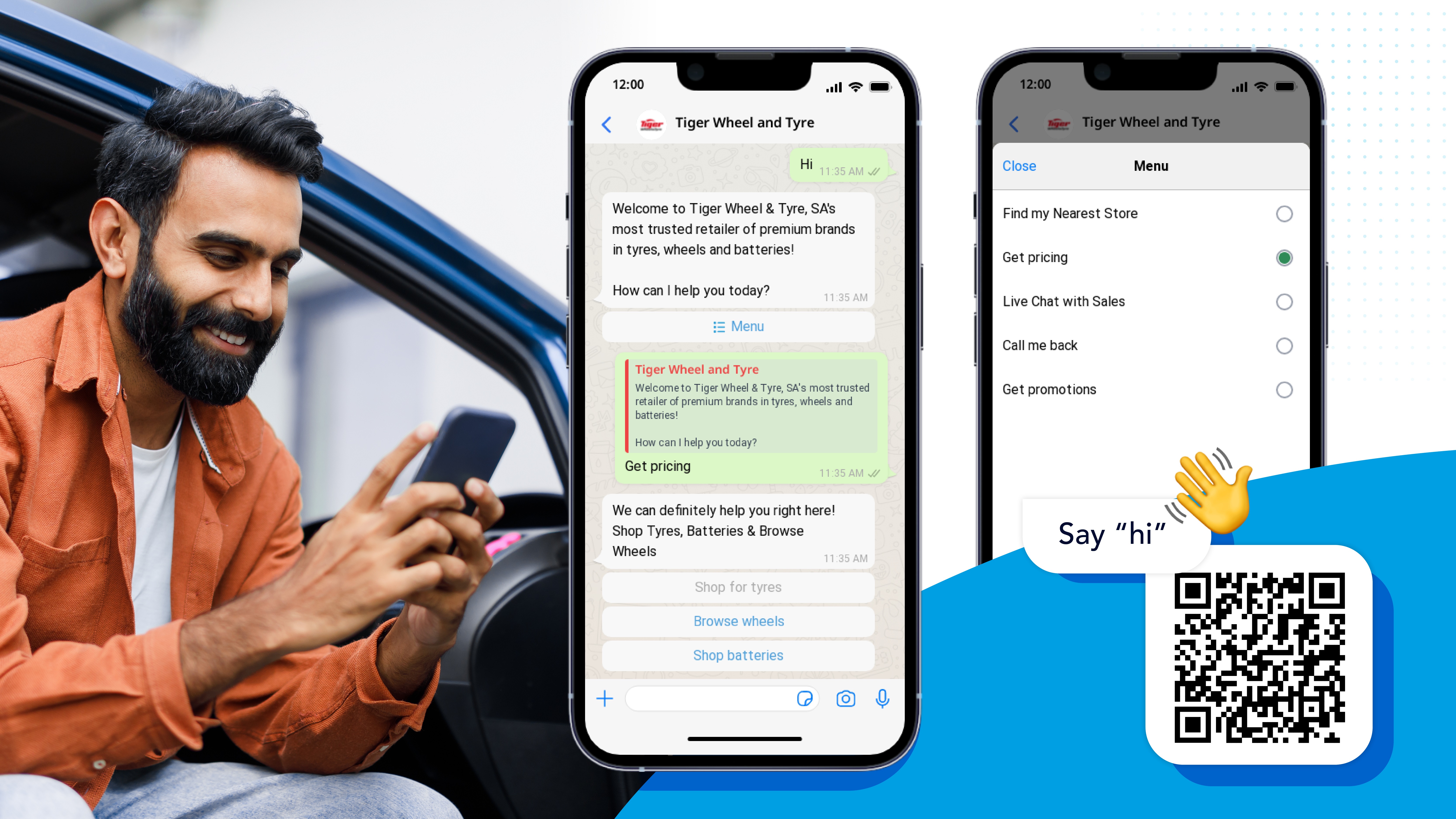

"Such ubiquity and simplicity created an opportunity for Cover2go to address the need for insurance, despite the traditional need to visit a physical office - often a geographic barrier to access in itself," says Africa. "No need to make time-consuming and often frustrating phone calls and no requirement for incomprehensible paperwork. The message to the customer: just click and transact."

99% of all GSM phones come equipped with USSD, which runs over the same channel as SMS. Generally associated with real-time or instant messaging phone services, USSD provides a "session-based" transactional mobile service. Likened to a secure internet session via an "SMS-like" interface, once the USSD-session is established, it remains active until the transaction is complete or the session times out. USSD, widely used by mobile operators for airtime top-ups, is being made more available to enterprises looking to launch compelling services. Typical of other short-message protocols, response times for interactive USSD-based services are almost immediate.

Clickatell USSD solutions enable transactional data to be transferred real time across the mobile channel with enhanced security and reliability. The benefits to Metropolitan and their customers are tremendous:

Security: USSD allows session-based communication between the server and the mobile device with no information left on the device

Real-time Connections: very low latency due to the nature of the wireless networks and session-based communications; communications initiated by simply entering service codes; no need to install, open, or learn a new application

More Insurance Options: access to new customer segments; more returning customers; more insurance options for those who need it, when they need it

Improved Convenience: quick and easy activation capabilities on the spot with mobile access to services

About Clickatell

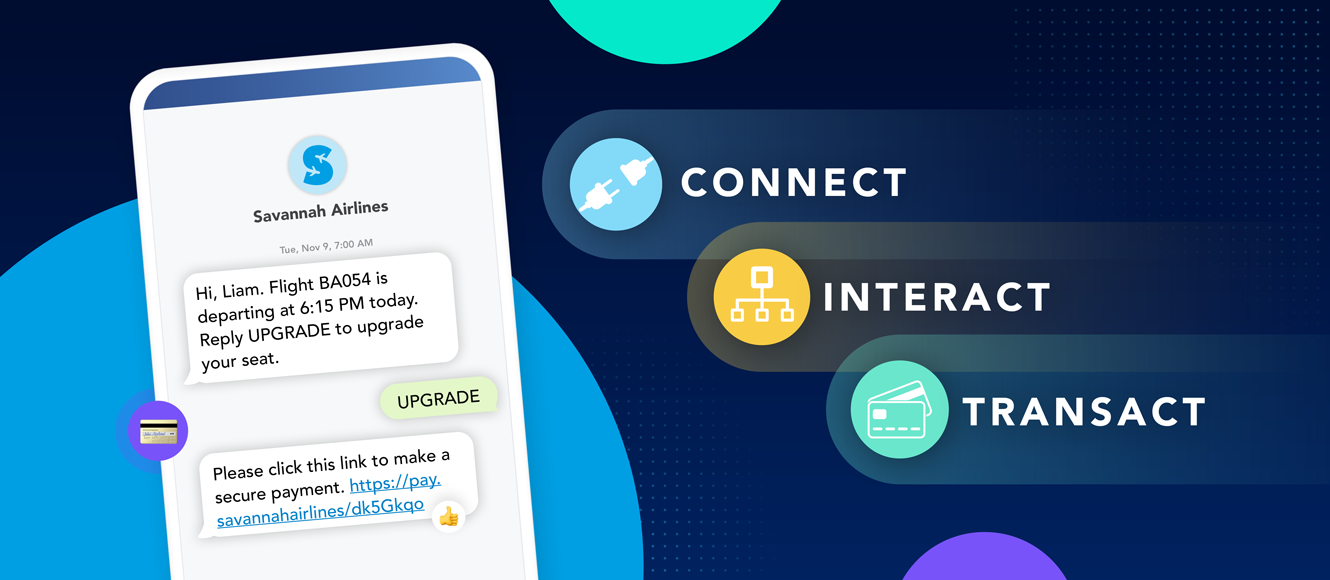

We create a better world through technology, making commerce in chat accessible for everyone, everywhere. Consumers can now connect with brands to find goods and services, make purchases, track orders, and resolve issues with a simple text or chat. No need for cash, phone calls, in-person interactions, or apps. Founded in 2000 with now over 10,000 customers, Clickatell is powering the digital commerce transformation. Clickatell is headquartered in Silicon Valley, CA and has offices in Canada, South Africa, and Nigeria (www.clickatell.com).

Latest Press Releases

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.