“Cybercrime cost U.S. businesses more than $6.9 billion in 2021, and only 43% of businesses feel financially prepared to face a cyber-attack in 2022.” - Forbes

There has been an interesting shift towards online shopping in the past three years, and with this has come the need for more safe and secure payment gateways. Cybercriminals have upped their game and are coming up with new and inventive ways to redirect customers’ cash, particularly during online transactions. Text payment portals, such as Chat 2 Pay, allow for a seamless shopping experience, from sourcing goods to making payments. These payment gateways also offer the necessary cyber security that ensures customer data is kept safe throughout. Here’s a look at how this works.

What is a payment gateway?

These essentially facilitate the transfer of financial data to and from financial institutions to authorise a transaction so that the merchant gets paid for a purchase. Through a payment gateway like Chat 2 Pay, your customers can make transactions through their preferred bank without compromising any sensitive data.

What are the payment gateway types?

There are currently three leading payment gateway types available for merchants to use. These include:

Redirect: This is where the payment gateway redirects a customer to a payment processor to complete the transaction.

Hosted or off-site payment: This is where the customer makes a purchase and the payment information is sent to the payment provider’s servers before the transaction is done.

Self-hosted or on-site payment: This is where the financial transaction takes place on the merchant’s servers.

What are the risks of not using a safe payment gateway?

“Around the world, the frequency of ransomware attacks remains high, as do related claims costs. There was a record 623 million attacks in 2021, double that of 2020. Although frequency reduced by 23% globally during the first half of 2022, the year-to-date total still exceeds that of the full years of 2017, 2018 and 2019, while Europe saw attacks surge over this period.” - Allianz

The threat of data theft is a major concern for businesses, particularly when customers are completing financial transactions online. With remote workplaces creating more reliance on cloud infrastructure, companies are experiencing more cloud-based cyberattacks. Here’s a quick look at some of the cyber risks currently threatening businesses.

Ransomware: This is a type of malware that hackers use to encrypt files and then they charge a ransom for the decryption key. This can be incredibly detrimental to operations and there’s no guarantee that the system will be operational once the ransom is paid.

Social engineering: When it comes to payment gateways, people are often the biggest threat as they can so easily be tricked into handing over sensitive details. Phishing and whaling attacks via text can encourage customers to provide details to what is seemingly an authentic organisation – but it’s just a scam.

Supply chain attack: This form of online threat involves malware being distributed through a software vendor, thereby delivering malicious code to all the customers in the supply chain.

How does Chat 2 Pay work?

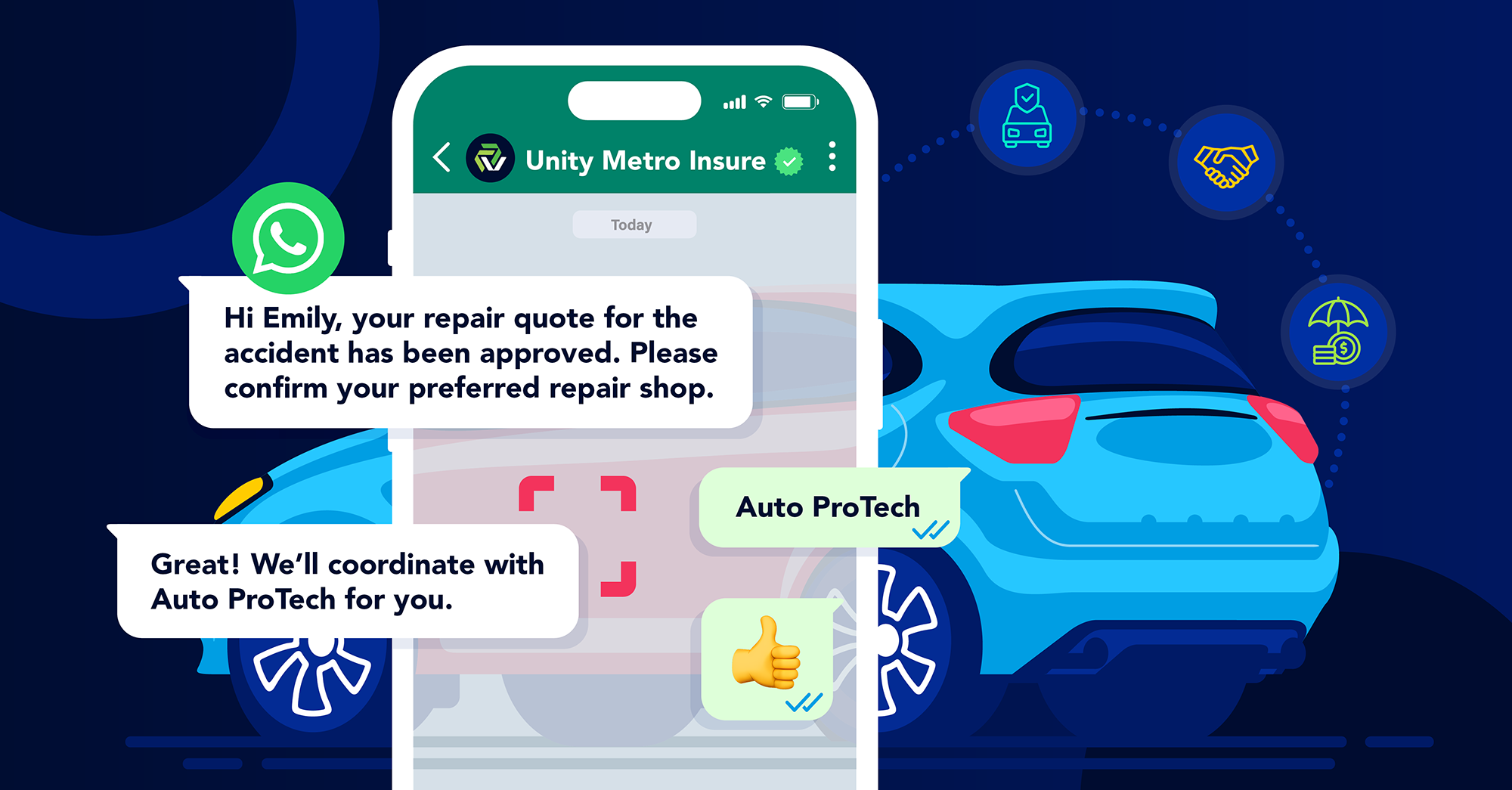

Chat 2 Pay is a component of the Clickatell Chat Commerce platform that enables your business to accept payments securely within chat messaging by sending a payment link via SMS or WhatsApp. This payment within messaging is a simple, three-step process:

Step 1: The payment request is sent by your business to your customer as a link in an SMS or WhatsApp.

Step 2: Once your customer has received the link, they click on it and they’re redirected to a secure checkout webpage. For Chat 2 Pay, this is powered by Cybersource.

Step 3: Your customer fills in their payment details which are then submitted. They will then receive confirmation of the order and receipt via SMS or WhatsApp.

What sets Chat 2 Pay apart?

“By taking the payment capabilities brands have on their websites, apps, and in their call centres, and making them available via chat, simpler payments will further drive adoption of this low-cost, efficient channel for interactions and transactions.” - Clickatell CEO, Pieter de Villiers

While cyber threats will always emerge, you can provide your customers with a safe and secure payment gateway to better protect them and their data in all transactions. Chat 2 Pay has emerged as the leading text payment option developed by Clickatell. Having decades of industry experience in developing chat commerce solutions for customers, Chat 2 Pay is the ultimate payment gateway for the global market.

1. Increased security

Chat 2 Pay mitigates the risk of merchants managing payment card details. Because Chat 2 Pay is integrated with Cybersource, businesses are benefitting from a secure payment gateway that has more than 260 fraud detectors.

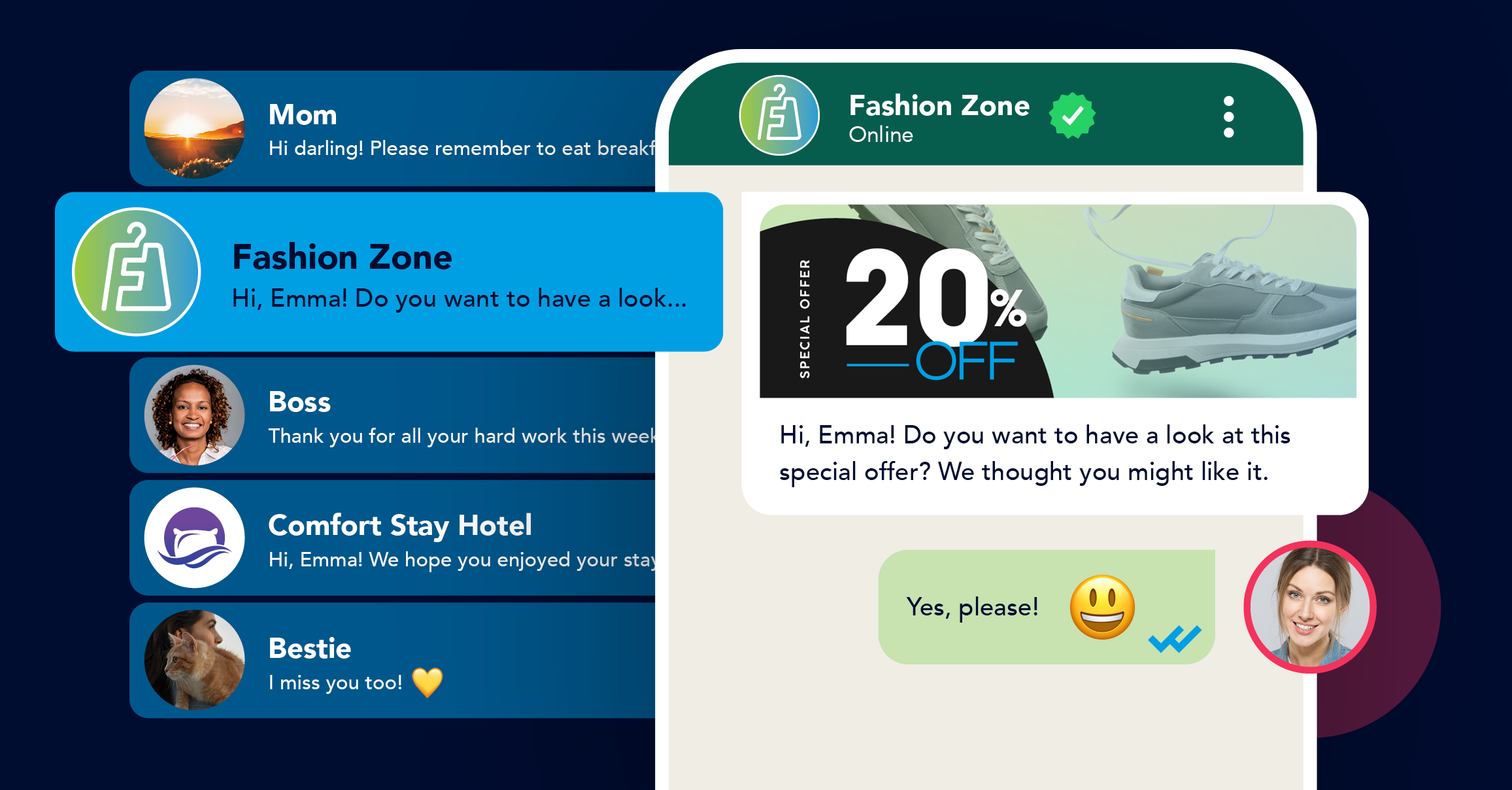

2. Preferred platform

Chat 2 Pay allows your customers to navigate payments within WhatsApp and SMS – two of the most prolific conversational apps available today. This makes them feel a lot safer when making payments as they understand the platform they’re using.

3. Wider reach

The beauty of Chat 2 Pay is that it can be used across many countries. You don’t want to limit your business by locality simply because the payment gateway doesn’t facilitate cross-border transactions. Chat 2 Pay allows for global payments at any time of day.

4. Convenience

Customers don’t want to navigate complex systems to make a purchase, they need simplicity and convenience. Chat 2 Pay is just that! It facilitates this contact-free text payment without any complexity, meaning customers can enjoy an entirely mobile shopping experience.

5. Better customer experience

The ease with which Chat 2 Pay is used makes for a much better customer experience and improved customer retention in the long run.

Who can use Chat 2 Pay?

The other great thing about Chat 2 Pay is that it facilitates payments for a number of businesses across a range of industries. For some idea, here is how Chat 2 Pay is being used:

Retail: All retail offerings, from food and flowers to groceries and electronics, can be paid for through Chat 2 Pay.

Travel: Airlines can use Chat 2 Pay for purchasing tickets and upgrades

Construction: Building materials can be paid for by contractors on Chat 2 Pay.

Telecommunications: Customers can pay their bills using Chat 2 Pay.

Hospitality: Customers can pay for hotel bookings and more.

Chat 2 Pay on the Clickatell Chat Commerce platform is not only convenient, it offers you a safe and secure way to accept all customer payments. Get in touch with Clickatell to find out more!

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.