Customer experience (CX) is a critical factor in the success of retail banks. In an industry where products and services are often commoditized, how a bank interacts with its customers can set it apart from the competition. Modern customers expect seamless, personalized, and convenient experiences and are more likely to stay loyal to a bank meeting these expectations..

However, delivering a superior customer experience in retail banking is no easy feat. Banks must navigate complex regulations, ensure the security of sensitive customer information, and provide support across multiple channels and geographies. This is where the WhatsApp Business Platform, integrated with Clickatell’s Chat Commerce Platform, can make a significant impact.

Addressing Key Pain Points with the WhatsApp Business Platform

Retail banks face several pain points that can negatively impact customer experience. These include challenges with onboarding new customers, managing fraud notifications, handling international communications, and providing timely notifications. Let’s dive into how WhatsApp Business can address these issues.

1. Getting Started with Banking

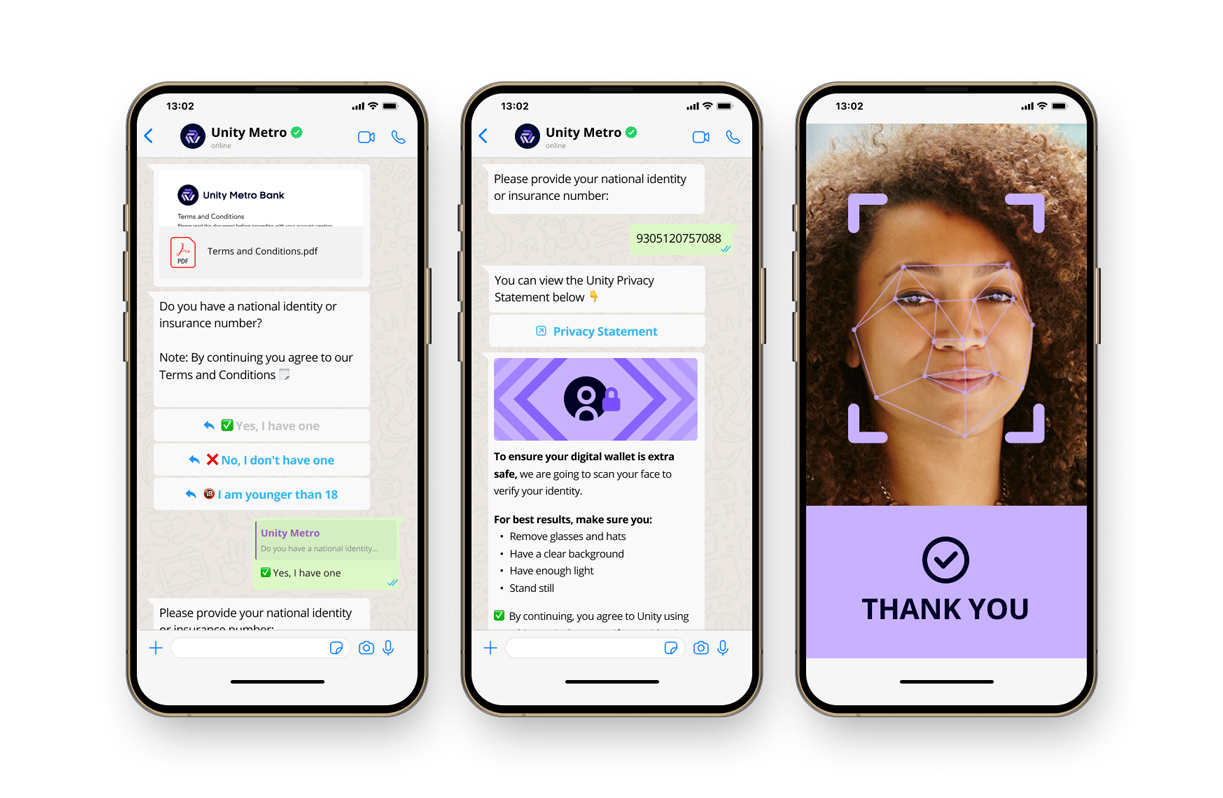

Onboarding new customers is a critical phase in the banking relationship. A complicated or lengthy onboarding process can lead to customer frustration and abandonment. Traditionally, onboarding involves multiple steps, including form filling, identity verification, and account setup, which can be time-consuming and cumbersome.

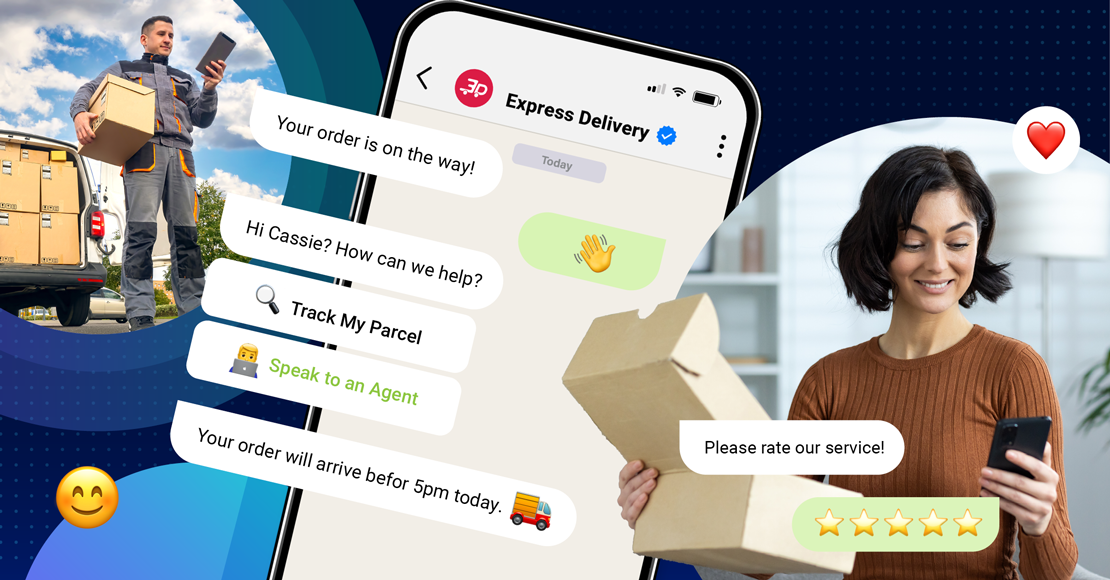

WhatsApp’s Role: WhatsApp can simplify the onboarding process by offering a user-friendly and familiar platform for communication. Through WhatsApp, banks can guide customers step-by-step through the onboarding process, answer questions in real time, and even collect necessary documents via secure messaging. This not only speeds up the process but also makes it more convenient for customers who are already using WhatsApp regularly.

Example: A potential customer interested in opening a savings account can initiate the process by simply messaging the bank on WhatsApp. The bank can then provide a seamless, interactive onboarding experience where the customer is guided through the necessary steps, with instant support available at every stage.

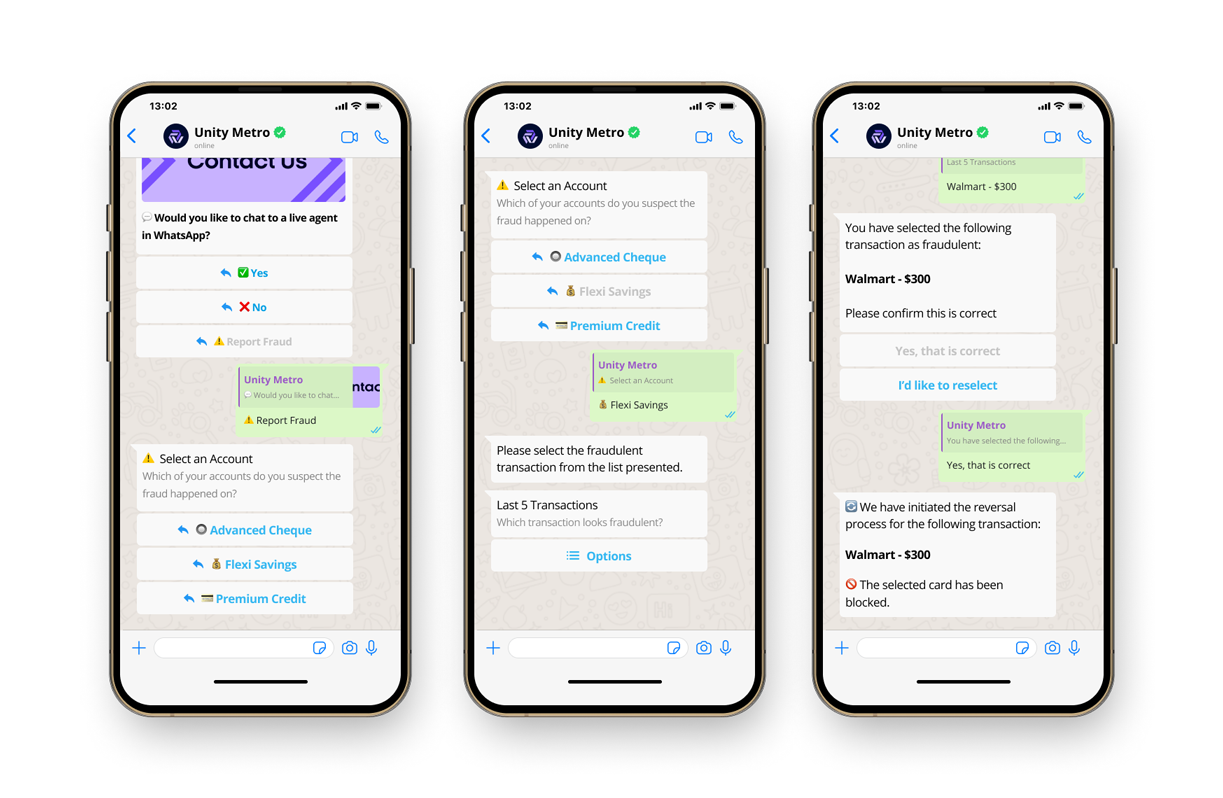

2. Fraud Notifications and Transaction Views

Fraud is a major concern for both banks and their customers. Timely detection and notification of fraudulent activities can prevent significant losses and protect customer trust. However, traditional methods of communicating fraud alerts, such as phone calls or emails, can be delayed or overlooked.

WhatsApp’s Role: WhatsApp offers an instant and direct communication channel for sending fraud alerts and transaction views. Banks can send real-time notifications to customers about suspicious activities or unauthorized transactions, allowing them to take immediate action. Additionally, customers can view their recent transactions directly within the chat app, making it easier to monitor account activity.

Example: If a customer’s credit card is used for an unusual transaction, the bank can immediately send a WhatsApp message alerting the customer to the activity. The customer can then confirm whether the transaction was authorized or not, all within the WhatsApp conversation.

3. International Communications with Customers

In today’s globalized world, customers frequently travel or reside in different countries. This can create challenges for banks in maintaining effective communication, especially when traditional SMS messages fail to deliver or banking apps do not function properly abroad.

WhatsApp’s Role: WhatsApp’s global reach and internet-based messaging capabilities make it an ideal solution for international communications. Unlike SMS, which may not be delivered in certain regions, WhatsApp messages are reliable and can be sent and received as long as there is an internet connection. This ensures that customers can stay connected with their bank, no matter where they are in the world.

Example: A customer traveling internationally may need to receive a One-Time Password (OTP) to complete a transaction. With WhatsApp, the bank can deliver the OTP instantly, even if the customer’s phone number is not connected to a local network. This eliminates the frustration of missed OTPs and ensures that customers can complete transactions securely while traveling.

Enhancing the Full Customer Journey with WhatsApp

Beyond addressing specific pain points, WhatsApp can enhance the entire customer journey, from awareness and consideration to purchase and post-purchase support. Let’s explore how WhatsApp can transform each stage of the buying cycle.

1. Awareness

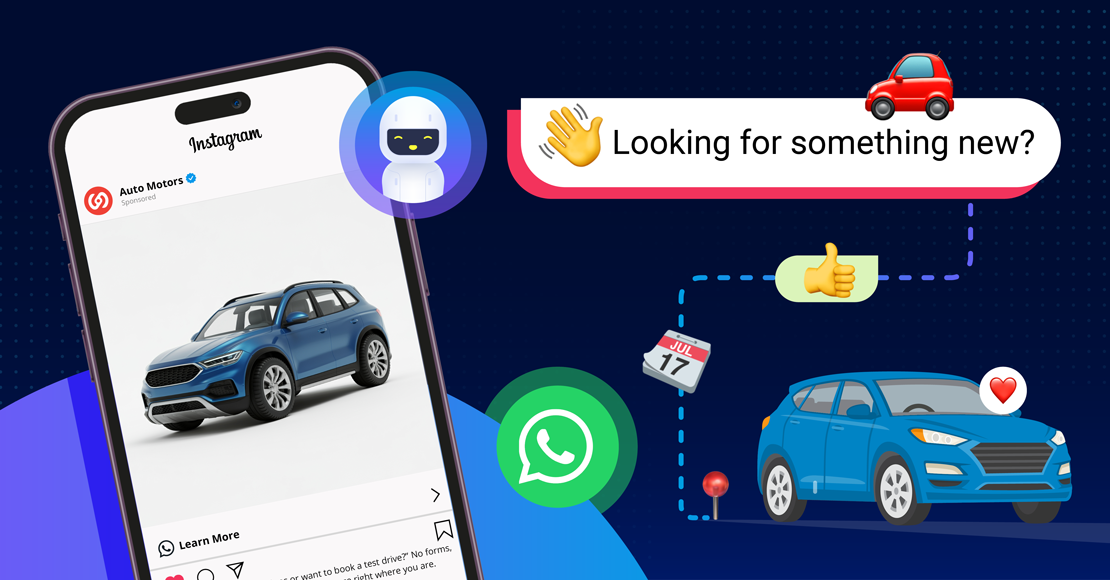

The first stage in the customer journey is awareness, where potential customers learn about the bank’s products and services. Traditionally, banks rely on advertising, social media, and their website to generate awareness.

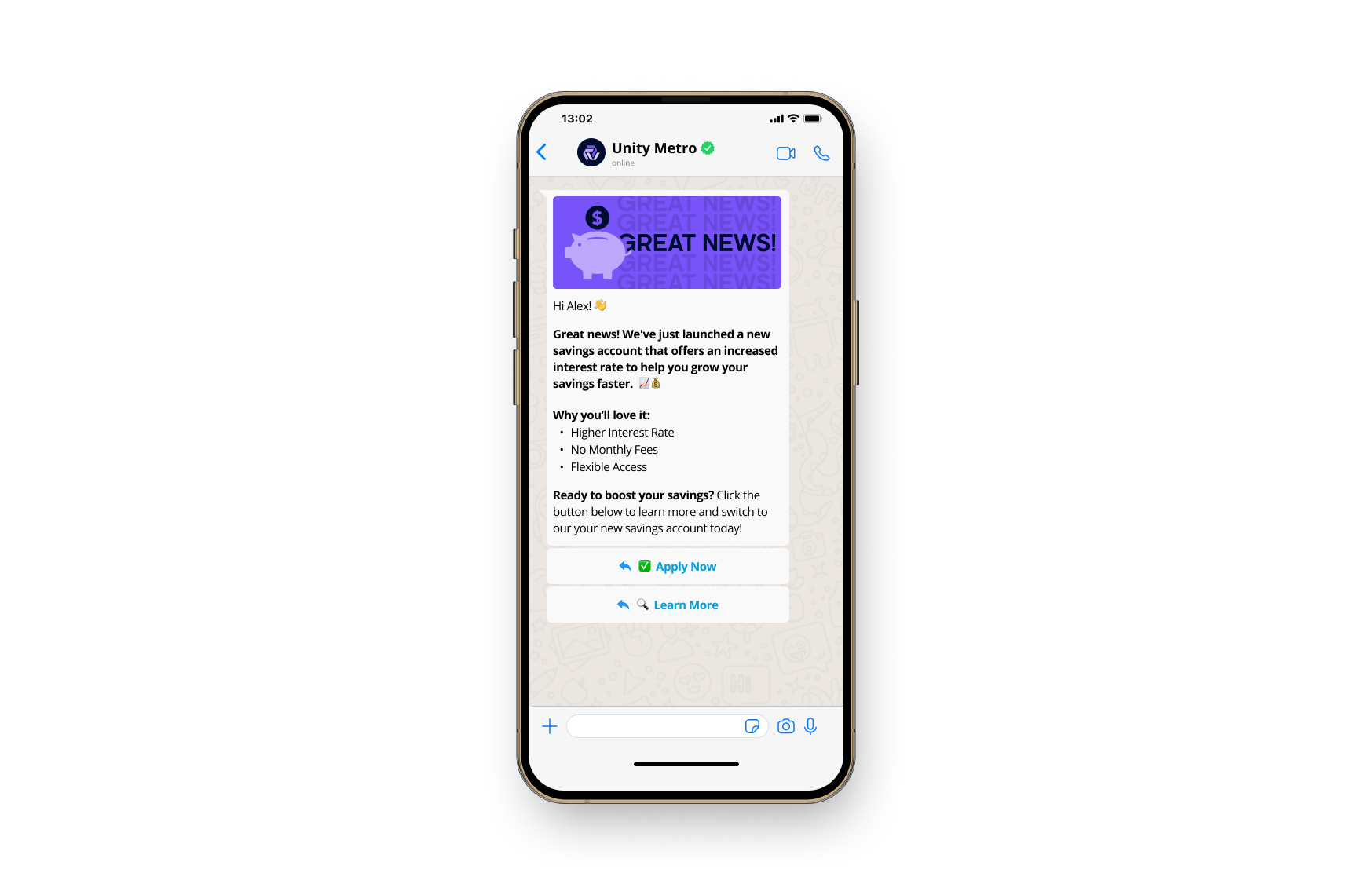

WhatsApp’s Role: WhatsApp can be used as a direct marketing channel to share personalized messages, promotional offers, and updates with customers. Banks can create broadcast lists to send targeted messages to specific customer segments, ensuring that the right information reaches the right audience.

Example: A bank could send a WhatsApp message to existing customers about a new savings account offering higher interest rates. This targeted approach not only increases awareness but also encourages customers to take action.

2. Consideration

Once customers are aware of the bank’s offerings, they enter the consideration phase, where they evaluate their options and compare products. During this stage, customers may have questions or need additional information to make an informed decision.

WhatsApp’s Role: WhatsApp’s interactive messaging capabilities allow banks to provide real-time support to customers during the consideration phase. Customers can ask questions, request more information, and receive personalized advice directly from a bank representative.

Example: A customer considering a mortgage could reach out to the bank via WhatsApp to inquire about interest rates, repayment terms, and eligibility criteria. The bank can respond promptly with detailed information and even schedule a follow-up call or in-person meeting if needed.

3. Purchase

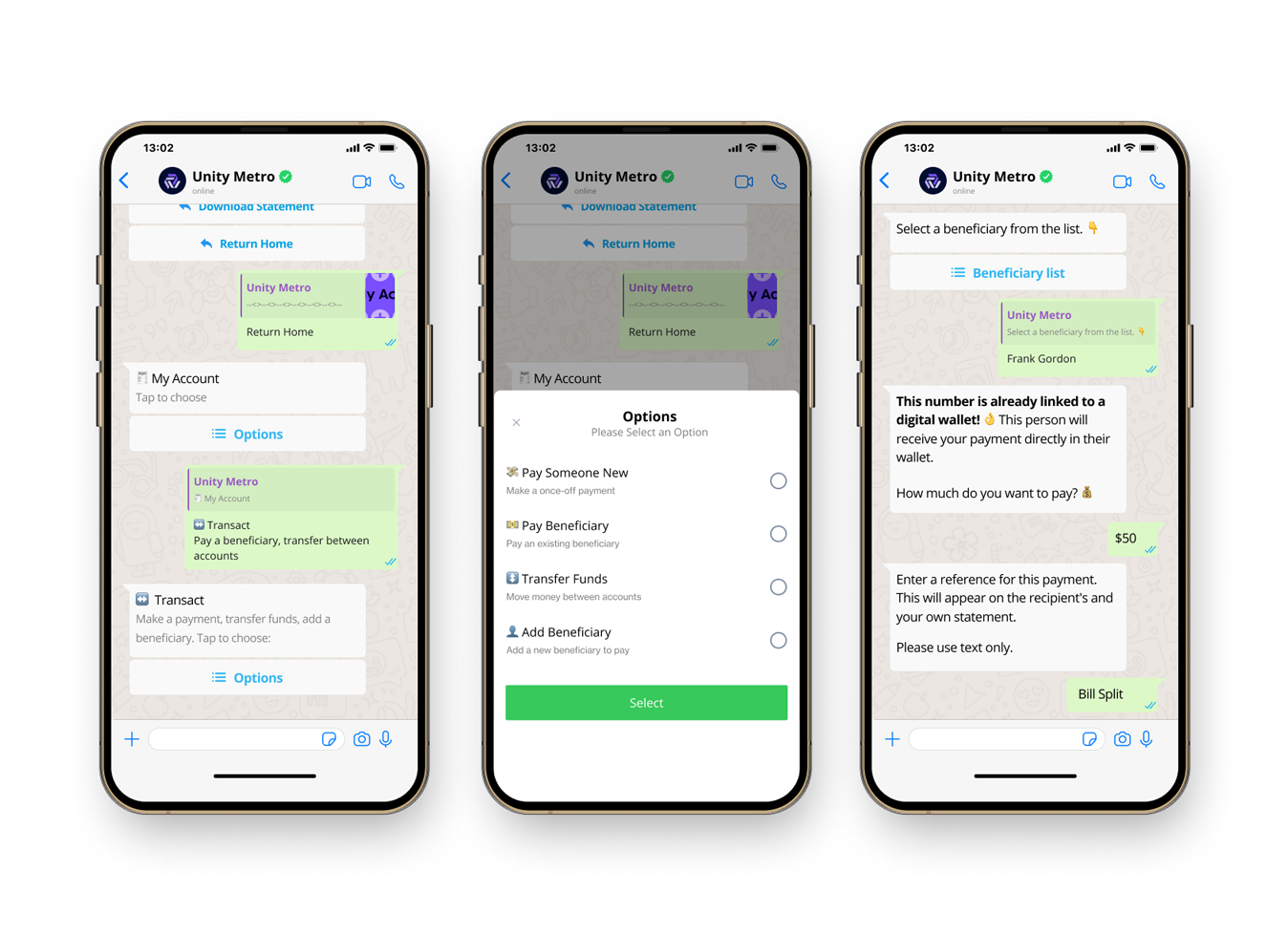

The purchase stage is where customers decide to proceed with a particular product or service. This is a critical moment in the customer journey, and any friction during this stage can result in lost opportunities.

WhatsApp’s Role: WhatsApp can streamline the purchase process by facilitating transactions directly within the chat app. Customers can complete loan applications, finalize account openings, and even make payments through WhatsApp, making the process quick and convenient.

Example: A customer who has decided to take out a personal loan can submit the application through WhatsApp. The bank can then process the application, request additional documents if necessary, and provide real-time updates on the status of the loan — all within the WhatsApp conversation.

4. Customer Care and Support

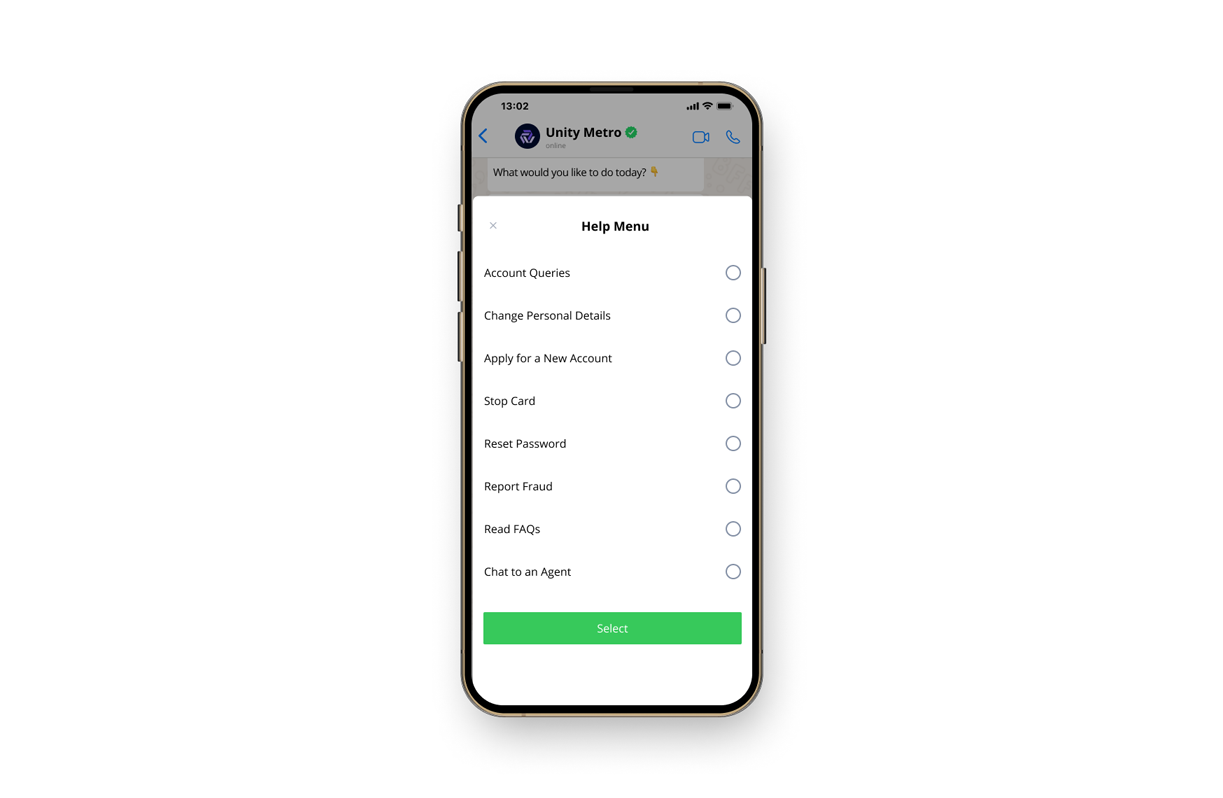

Post-purchase support is crucial for maintaining customer satisfaction and loyalty. Customers expect prompt and efficient assistance when they encounter issues or have questions about their accounts.

WhatsApp’s Role: WhatsApp provides a convenient and accessible platform for customer support. Banks can use WhatsApp to offer 24/7 support, automate frequently asked questions, and resolve issues quickly. Additionally, the platform’s multimedia capabilities allow banks to send videos, images, and documents to assist customers.

Example: If a customer encounters a problem with their online banking account, they can contact the bank through WhatsApp for immediate assistance. With Clickatell's AI-driven solution, the bank can automate initial responses, guiding the customer through troubleshooting steps based on their inquiry. If the issue requires further attention, the AI can seamlessly escalate the situation to a human support agent, ensuring that the customer receives the help they need quickly and efficiently.

Beyond Communication: WhatsApp’s Role in Regulatory Compliance

In addition to enhancing customer experience, WhatsApp can also help retail banks meet regulatory requirements such as FICA (Financial Intelligence Centre Act) and KYC (Know Your Customer) compliance. These regulations require banks to verify the identity of their customers and monitor transactions to prevent money laundering and other illicit activities.

WhatsApp’s Role: WhatsApp can facilitate the collection of necessary documents and information for FICA and KYC compliance. Customers can securely submit identification documents, proof of address, and other required information through WhatsApp, streamlining the verification process.

Example: When opening a new account, a customer can use WhatsApp to send a copy of their ID and a utility bill as proof of address. The bank can then verify the documents and complete the KYC process without requiring the customer to visit a branch.

Transforming Retail Banking with WhatsApp

In an increasingly competitive and digital-first banking landscape, customer experience is a key differentiator. Retail banks that leverage innovative communication channels like WhatsApp Business can not only address critical pain points but also enhance the entire customer journey.

From simplifying onboarding and managing fraud notifications to facilitating international communications and ensuring regulatory compliance, WhatsApp offers a versatile and powerful solution for retail banks. By integrating WhatsApp into their customer experience strategy, banks can create more meaningful, convenient, and secure interactions with their clients, ultimately driving satisfaction and loyalty.

Clickatell’s WhatsApp Business solution is designed to help retail banks unlock the full potential of this platform, ensuring that they can meet the evolving needs of their customers in a rapidly changing world. Whether it’s enhancing customer support, streamlining processes, or improving communication across borders, WhatsApp is poised to transform the way retail banks engage with their clients—now and in the future. Contact us today to learn more!

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.