In today's fast-paced digital world, convenience is key when it comes to making payments. With the rise of mobile apps and social media platforms, consumers expect seamless and secure transactions at their fingertips. This demand for convenience extends to call centers, where customers often make payments over the phone. To ensure the security of cardholder data and comply with industry standards, call centers need to adhere to the Payment Card Industry Data Security Standard (PCI DSS). In this article, we will explore how chat payments can be utilized in call centers to enable PCI DSS 4 compliance.

Understanding PCI DSS and its Importance

PCI DSS, or Payment Card Industry Data Security Standard, is a set of security standards designed to protect cardholder data during payment transactions. It applies to any organization that accepts, processes, stores, or transmits cardholder data. Compliance with PCI DSS is crucial for call centers to protect customer information, maintain trust, and avoid hefty fines or data breaches.

The Evolution of Call Center Payments

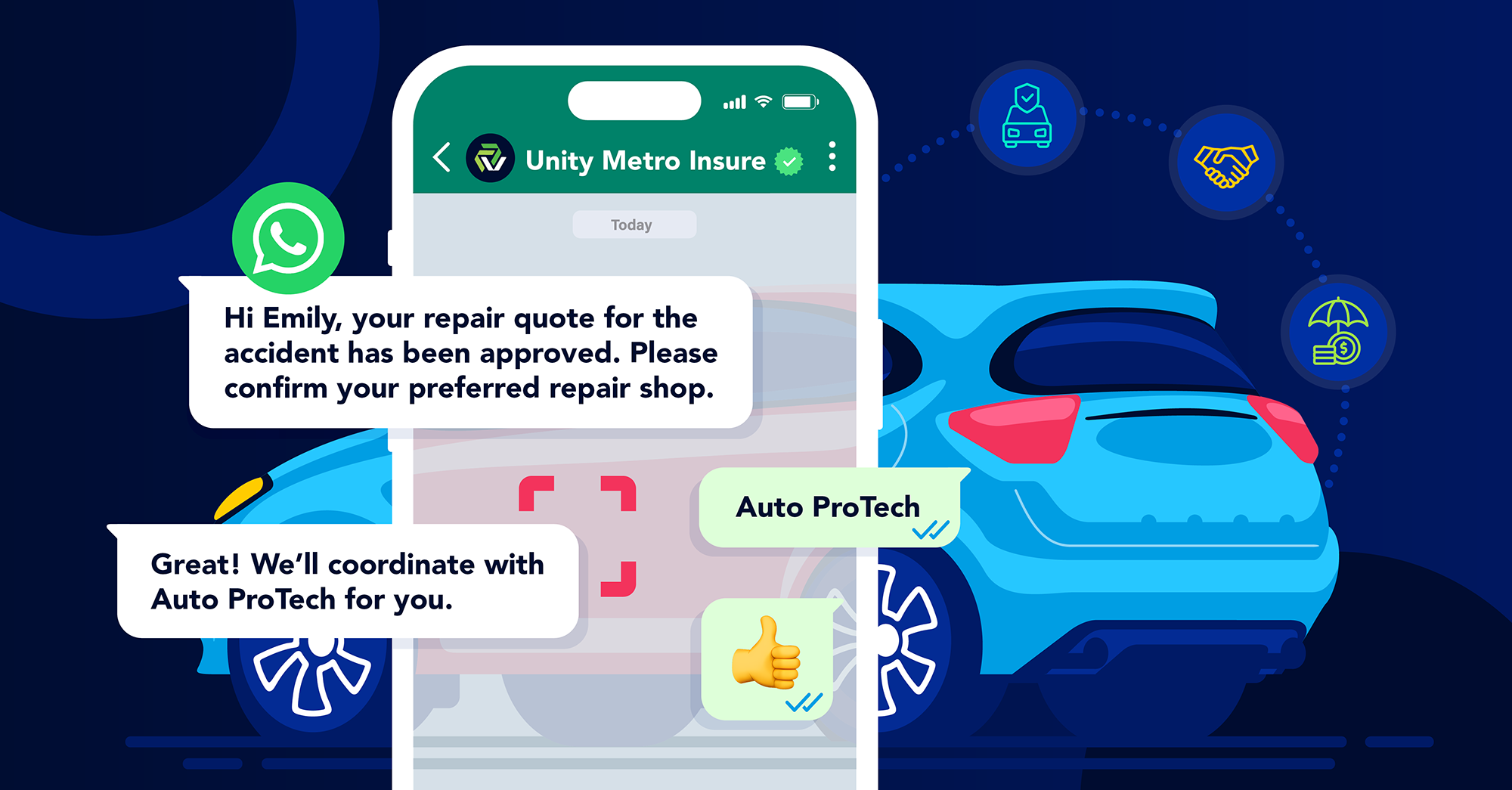

Traditionally, call center payments have relied on manual processes and the involvement of call center agents. This introduces a human element into the transaction, making PCI DSS compliance more challenging. However, advancements in technology have paved the way for chat payments in call centers, providing a secure and compliant alternative.

Benefits of Chat Payments for Call Centers

Implementing chat payments in call centers offers several advantages, both for the business and the customer. Let's explore some of the key benefits:

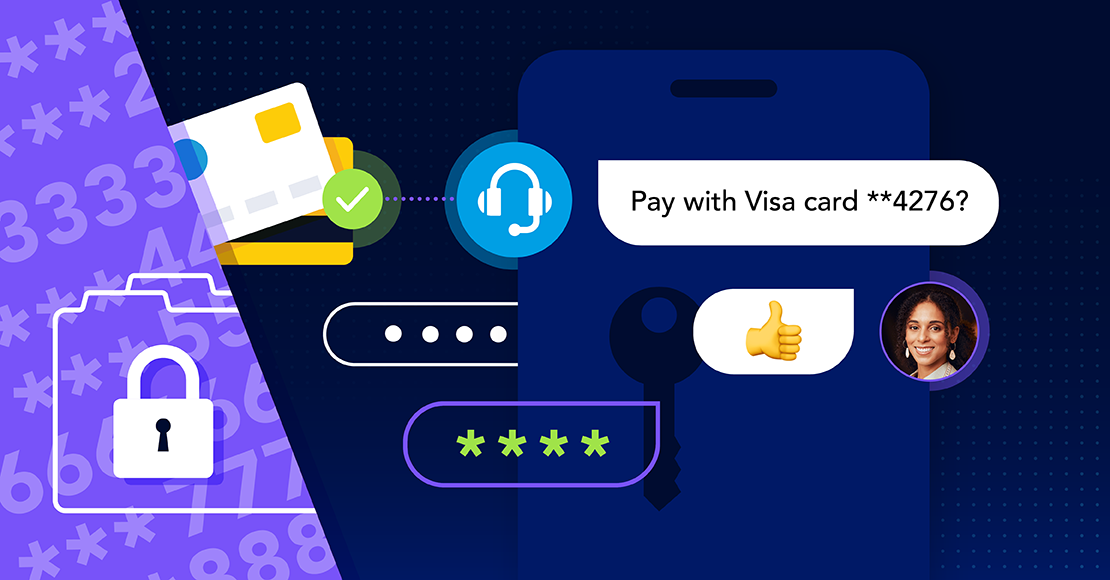

Enhanced Security: Chat payments utilize encryption and secure transmission protocols, ensuring the protection of cardholder data. By eliminating the need for agents to handle sensitive information, the risk of data breaches is significantly reduced.

Improved Customer Experience: Chat payments offer a seamless and convenient payment experience for customers. They can make payments without having to disclose their card details to an agent, providing a sense of security and control.

Streamlined Operations: By automating the payment process through chat payments, call centers can increase efficiency and reduce manual errors. This allows agents to focus on providing excellent customer service rather than handling payment transactions.

Cost Savings: Implementing chat payments can lead to cost savings for call centers. With fewer manual processes and reduced risk of data breaches, businesses can avoid fines and reputational damage associated with non-compliance.

Ensuring PCI DSS 4 Compliance with Chat Payments

To achieve and maintain PCI DSS 4 compliance, call centers must follow specific guidelines when implementing chat payments. Here are some key considerations:

Scope Definition

Before implementing chat payments, call centers need to define the scope of their PCI DSS compliance. This includes identifying the people, processes, and technologies that interact with cardholder data. By reducing the scope, call centers can minimize compliance costs and operational risks.Secure Data Storage

One of the crucial requirements for PCI DSS compliance is protecting stored cardholder data. With chat payments, call centers should limit the storage of cardholder data and ensure that any stored data is encrypted and masked. Regular purging of unnecessary data is also essential to minimize the risk of data breaches.Encryption of Data Transmission

To secure the transmission of cardholder data, call centers must implement encryption protocols. Chat payment systems should use robust security protocols such as TLS/SSL to safeguard sensitive information during transmission, even over public networks. This ensures that data remains protected from potential interception by hackers.Access Control and User Authentication

Implementing strong access control measures is essential for maintaining PCI DSS compliance. Call centers should assign unique user IDs to employees and restrict access to cardholder data based on the principle of least privilege. Additionally, implementing multi-factor authentication can provide an extra layer of security and prevent unauthorized access.Regular Security Testing and Monitoring

To ensure ongoing compliance, call centers should conduct regular security testing and monitoring. This includes vulnerability assessments, penetration testing, and monitoring access to network resources and cardholder data. By identifying and addressing security weaknesses promptly, call centers can maintain a robust security posture.Documentation and Training

Maintaining comprehensive documentation and providing regular training to employees is crucial for PCI DSS compliance. Call centers should document their policies, procedures, and security controls, ensuring that employees are aware of their responsibilities. Regular training sessions can help reinforce security best practices and keep employees informed about evolving compliance requirements.

Conclusion

Implementing chat payments in call centers provides a secure and compliant solution for processing payments over the phone. By adhering to PCI DSS 4 standards and following best practices, call centers can ensure the protection of cardholder data and maintain customer trust. The benefits of chat payments, including enhanced security, improved customer experience, and streamlined operations, make it an attractive option for call centers looking to achieve PCI DSS compliance. By embracing the power of technology and innovation, call centers can provide seamless and secure payment experiences while meeting industry standards.

Remember, PCI DSS compliance is an ongoing process, and call centers must stay vigilant in maintaining their security measures to protect cardholder data and adapt to evolving threats. With the right strategies and a commitment to security, call centers can pave the way for a safer and more efficient payment experience for their customers.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.