Clickatell partners with Sterling Bank

Redwood City, CA - Clickatell, the global leader in mobile communications specializing in SMS messaging as a service, today announced that Sterling Bank has launched its CardGuard fraud protection service using Clickatell's award-winning messaging platform. The addition of Sterling Bank to its stable of financial services organizations across Africa extends Clickatell's leadership as the top banking message provider on the Continent. Expanding into Nigeria, Clickatell is responding to rising customer demand for messaging services that deliver to end users more information and services via their mobile phone.

A first among Nigerian banks, Sterling Bank's CardGuard incorporates the customer's mobile phone into its network of services. Banks across Africa have tapped into the ubiquity of the mobile phone to interact with their customers and enlist their help in monitoring card activity for fraudulent charges. Clickatell works with the largest banks in South Africa and Kenya, for example, to provide SMS messaging for banking customer service and fraud monitoring, and that trend has now come to Nigeria with Sterling Bank. With CardGuard, Sterling Bank customers can now use their mobile devices to freeze their account should they note a fraudulent withdrawal.

"The mobile phone is a powerful customer service channel that helps us respond immediately to our customers while providing an extra layer of protection, for them and for us, against fraudulent activities," said Devendra Puri, Executive Director, Operations and Technology of Sterling Bank. "Clickatell comes with a wealth of experience in working with financial services providers and we wanted a leading partner in launching this valuable new product. The cost-effective and reliable service that Clickatell provides helped us to improve our customer relationship and protect our bottom line while opening a new revenue source with new mobile capabilities."

Sterling Bank is one of the thousands of brands worldwide that are discovering new ways to engage customers, and their own employees and partners, using the ubiquity of SMS messaging. Almost all of the world's five billion mobile phones are able to at least receive SMS text messages. One of the world's largest providers of SMS services, Clickatell has provided customers with real-time, priority alert messaging through its Secure Enterprise Mobile Messaging Gateway since 2000. Clickatell works with developers worldwide to build applications that help brands increase customer contact and conversation, form social communities, motivate and reward buying or referral behavior, deliver just-in-time deals and incentives, as well as prompt usage, consumption or purchase. Additionally, organizations tap Clickatell for programs that assist partners and employees with process or operational improvement, cost reduction initiatives, disaster avoidance, emergency management and a host of other mission-critical goals.

"We have a broad range of experiences from working with banks throughout Africa and we're pleased to be expanding into the Nigerian banking market with our new relationship with Sterling Bank," said Pieter de Villiers, CEO of Clickatell. "Consumers are demanding their favorite brands provide greater interaction and capabilities through their mobile phone and Sterling Bank is out front in responding with its clever new CardGuard service."

About Clickatell

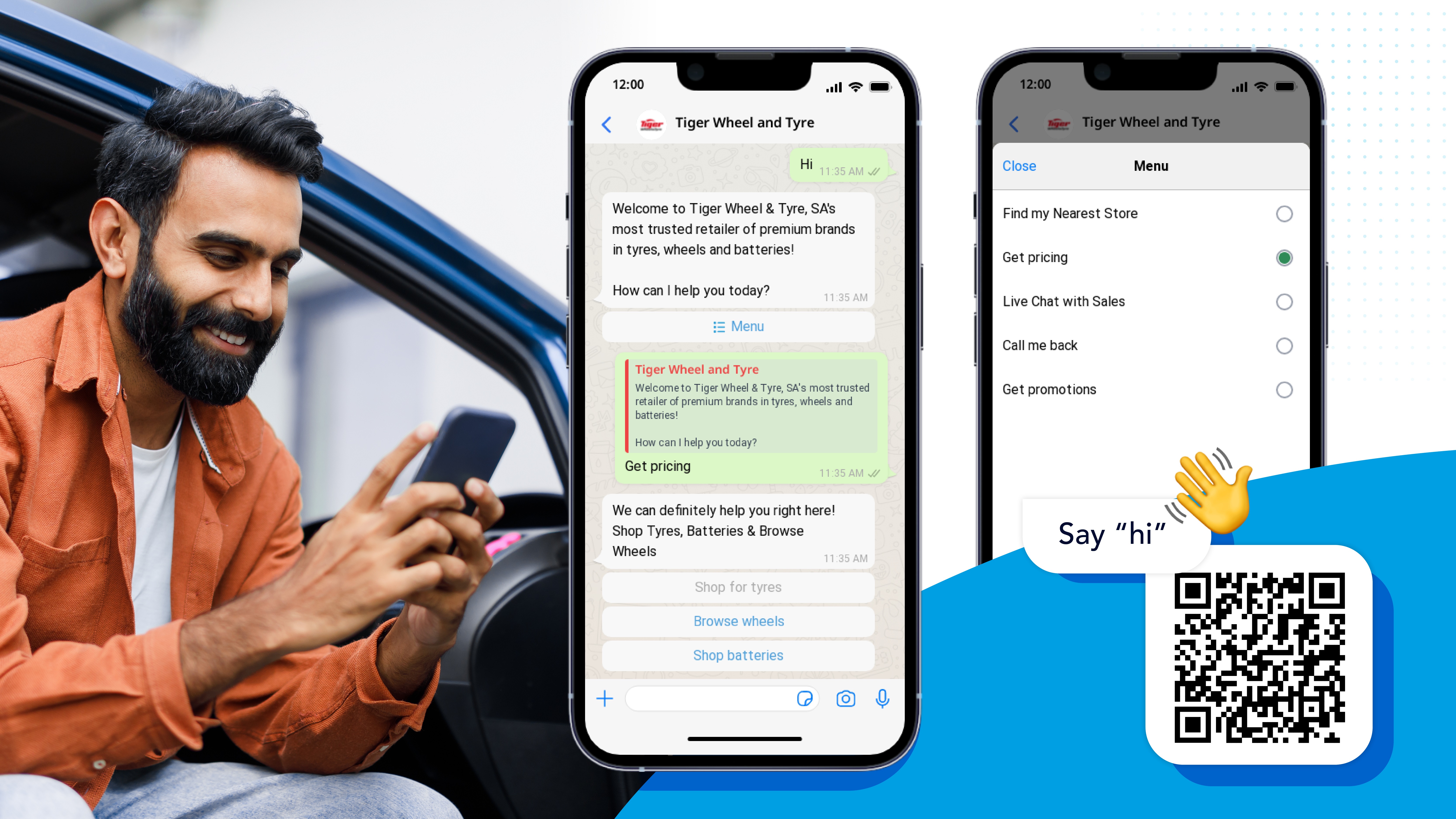

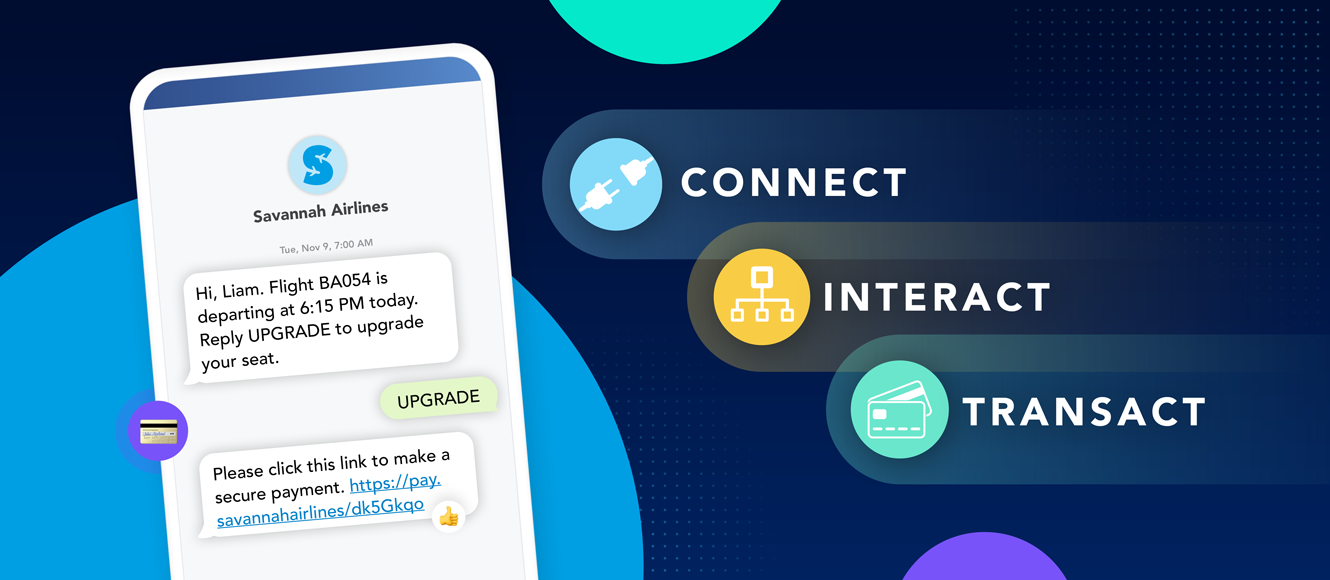

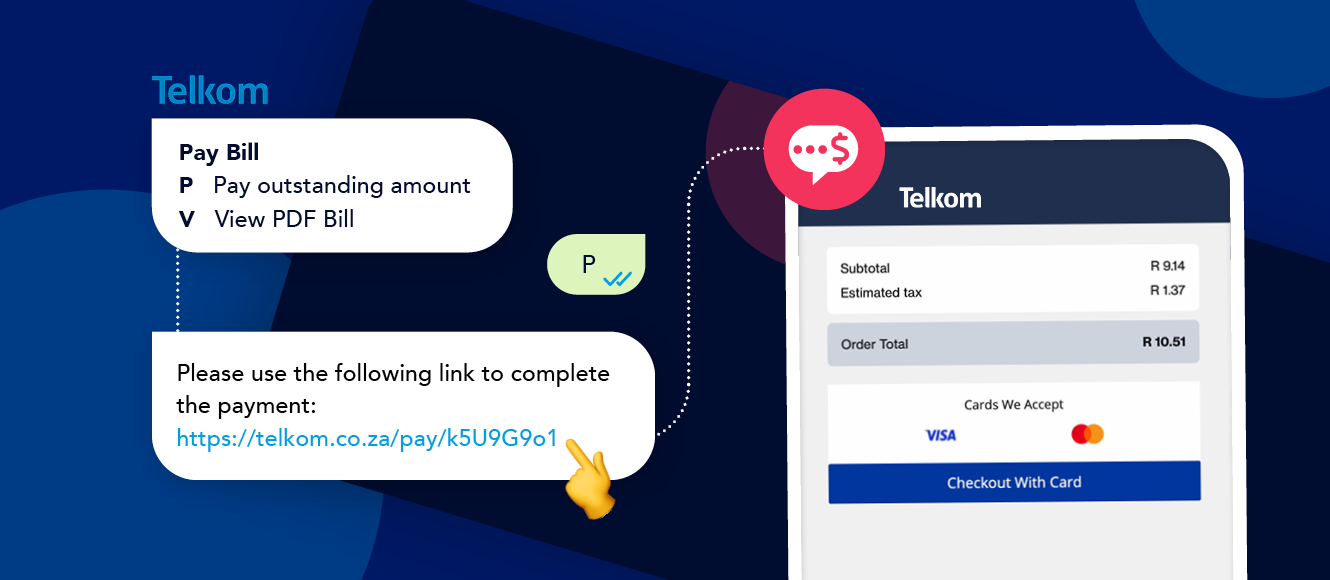

We create a better world through technology, making commerce in chat accessible for everyone, everywhere. Consumers can now connect with brands to find goods and services, make purchases, track orders, and resolve issues with a simple text or chat. No need for cash, phone calls, in-person interactions, or apps. Founded in 2000 with now over 10,000 customers, Clickatell is powering the digital commerce transformation. Clickatell is headquartered in Silicon Valley, CA and has offices in Canada, South Africa, and Nigeria (www.clickatell.com).

Latest Press Releases

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.