The Company

Unity Metro Insure

Unity Metro Insure* is a fast-growing, forward-thinking insurance brand, operating in over 10 African countries. Established in 2017, the company aims to help people build better futures. Unity Metro Insure believes that insurance empowers individuals to safeguard themselves, their families, and their possessions against the impact of certain adversities efficiently, affordably, and with ease. Their product offerings enable many people to secure insurance protection for the first time, helping to prevent financial difficulties that could otherwise entrench them in poverty.

Company size: 25,000+ employees

Location: Global

Products used: WhatsApp, Chat Flow, Chat Desk

The Context

The brand prides itself on its dedication to promoting financial inclusivity across Africa by offering protection to its people when they need it most during times of loss, illness, injury, and death. This is achieved through quick, convenient, and easy-to-use insurance services accessible via mobile phones.

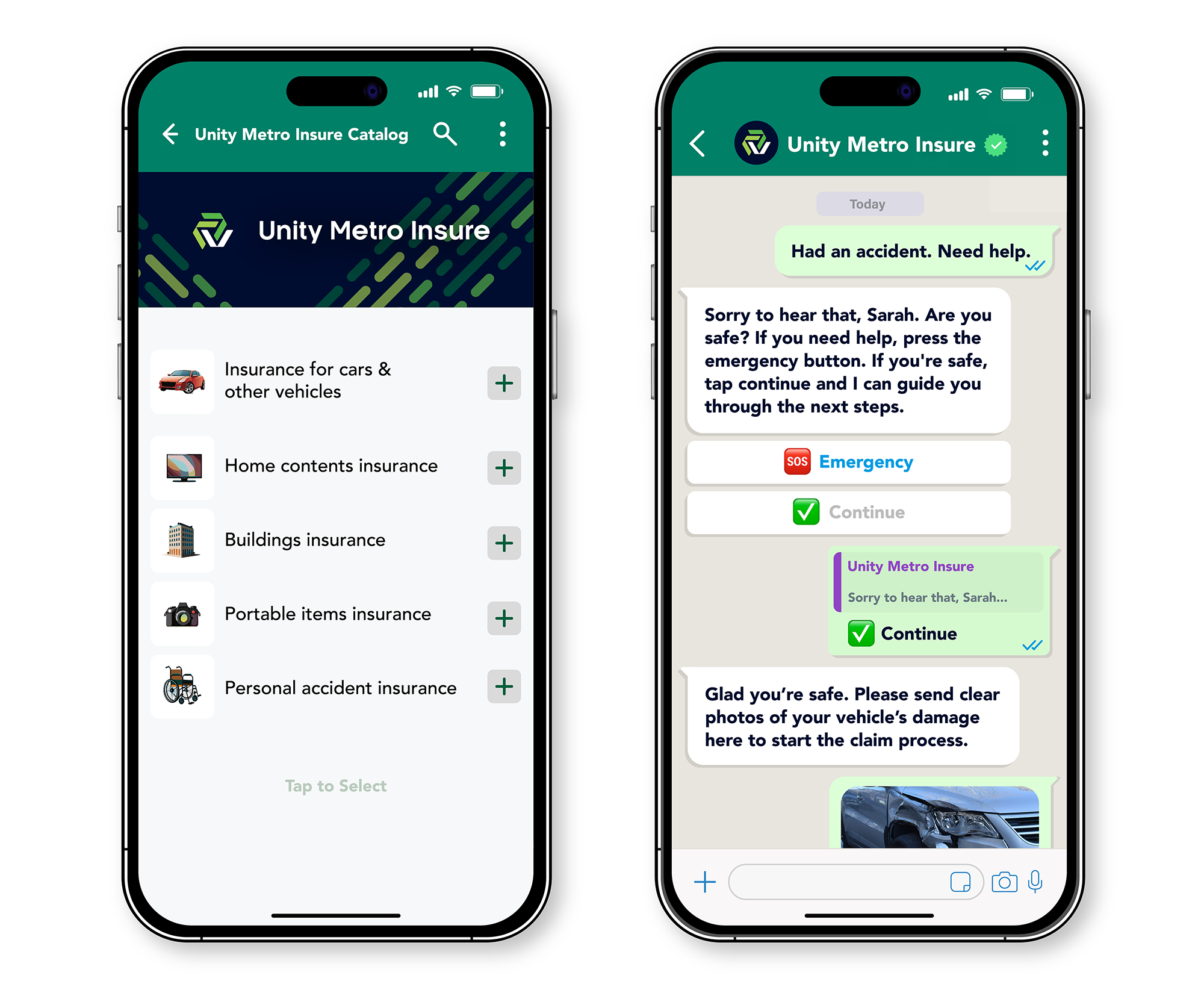

Unity Metro Insure has made significant strides in the insurance industry by introducing a cutting-edge digital suite of insurance solutions across all their markets, leveraging the most popular messaging channel, WhatsApp. This revolutionary suite, built on Clickatell’s Chat Commerce Platform, delivers insurance services through conversational exchanges that enhance the customer experience, streamline business processes, drive revenue, and provide comprehensive protection. This solution effectively enables faster implementation of services, benefiting Unity Metro insurers.

The Challenge

Manual Processes Hamper Business Growth

Unity Metro Insure has traditionally utilized methods such as call centers, emails, and website queries for customers to purchase products, process claims, manage policies, and get support. However, with exponential growth across several markets, they needed more innovative strategies to serve their customers well. Compared to modern digital connectivity, traditional methods present challenges for customers and hinder efficiency and effectiveness. Delays in processing claims during critical times and a prolonged initial purchasing process are usually the result.

Additionally, with an expansive product catalog and a broader customer base, simplifying product discovery and management across channels to suit niche customer requirements was another challenge. The brand aimed to provide a best-in-class insurance experience and support for its customers by strengthening its digital insurance presence with a curated support strategy utilizing the combination of AI and the WhatsApp Business API.

The Solution

Insurance Reimagined With WhatsApp

Unity Metro Insure designed and deployed their transformative solution to address these challenges right in WhatsApp, with support from Clickatell to provide the technology. The suite encompasses a range of insurance use cases, including onboarding, product quotes, purchasing, servicing, and claims, ensuring a seamless end-to-end experience for customers. To ensure localization and foster collaboration, Unity Metro Insure established a dedicated in-market “digital squad” using Clickatell’s chatbot builder, generative AI, and live agent support desk software. This solution aided in developing innovative digital experiences tailored to specific regions and customers.

To access this solution, users simply authenticate themselves using their national ID number via a pre-login menu. A post-login menu is then presented to any authenticated user and the ID number is temporarily stored for later use.

This groundbreaking solution fosters easy accessibility, building trust and transparency with customers by offering convenient support, simple quotes, purchases, and policy management. It also enables enhanced business analysis of live customer data through feedback and sentiment analysis. Unity Metro Insure represents an exciting development in digital insurance growth strategy across Africa. This is a crucial time for digital insurance across different markets as Unity Metro Insure continues to witness the growth of tech-savvy customers who lack adequate insurance coverage. They have embraced a holistic approach through Clickatell’s revolutionary Chat Commerce Platform, considering every facet of the digital insurance value chain to modernize the entire experience and be more responsive to evolving partner and customer needs.

Features In Detail:

Enrollment: Sign up for new coverage.

Call Me/Help: Request assistance or a callback.

Manage Profile: Update personal details.

Marketing Consent: Provide or withdraw marketing consent.

Manage Beneficiaries: Add, update, or remove a beneficiary.

Manage Family Members: Add or edit family members.

Manage Cover: Cancel, reinstate, or renew coverage.

Claims: File a claim for your policy or on behalf of someone else.

Agent Assist: Get help from a live agent.

FAQs: Find answers to frequently asked questions.

Conclusion

Digitalization at the Center of Business Operations

The launch of this WhatsApp solution by Unity Metro Insure is set to reshape the insurance landscape and disrupt the way customers access and experience insurance products. With its commitment to innovation and strategic partnerships, Unity Metro Insure is primed to strengthen its position as a market leader across regions while meeting the evolving needs of its customers and partners.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.