When Bad Luck Strikes

CRASH! 🚗 SPLOOSH! 💦 OH NO! 💍

People pay for insurance in the hopes that they will never need it. However, sometimes bad luck strikes, and you need assistance – fast.

Unfortunately, the traditional insurance processes add insult to injury by being notoriously difficult to navigate – lack of personal recommendations and rigid product offerings mean customers often have to settle for policies that do not fully cover their needs, submitting claims is tedious and time-consuming, and customers frequently have to wait for responses to queries in times of crisis.

Insurance companies are discovering the immense potential of the WhatsApp Business API as a rich digital communication tool to enhance operations and customer relationships. This widely used messaging platform offers a range of advantages that can significantly improve how insurers interact with clients and manage their services, offering app-like features outside of a mobile app.

From Frustration to Satisfaction: The New Customer Journey

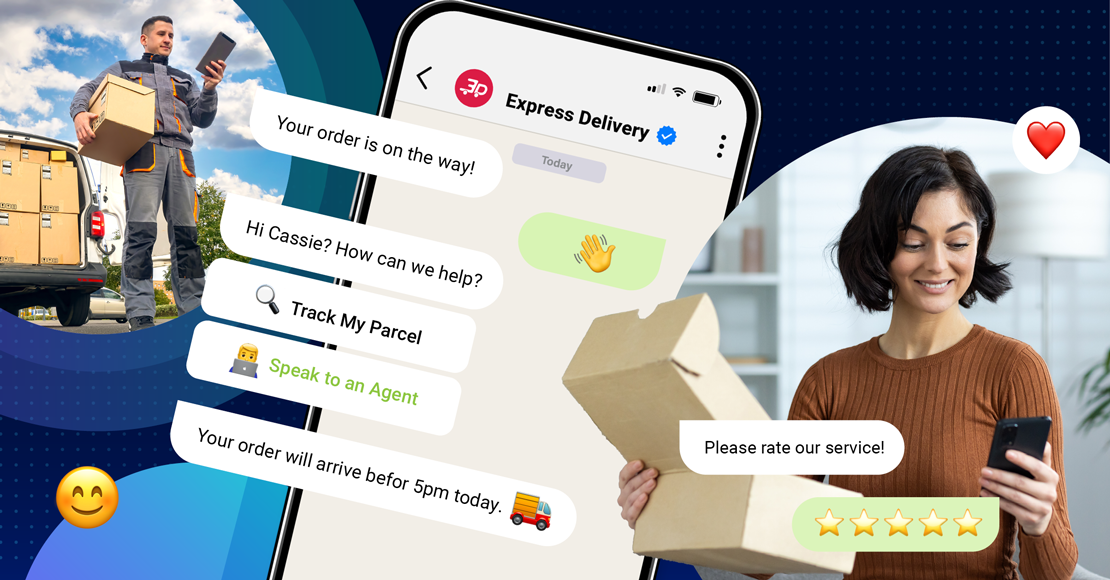

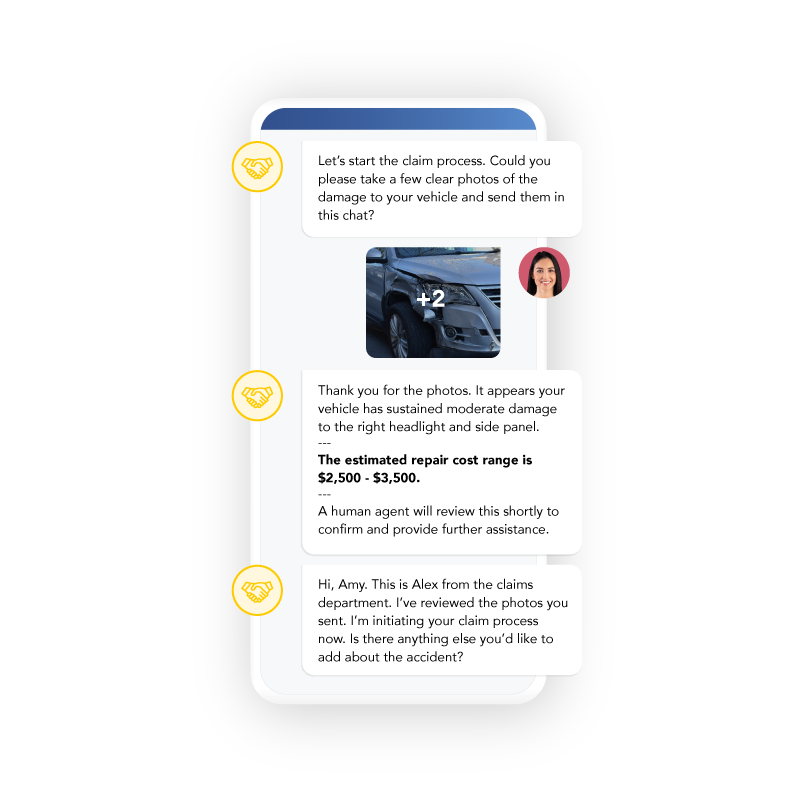

Picture this: 🚘💥🚙 Sarah's just had a fender bender. Instead of spending hours on hold, she simply opens WhatsApp and from start to finish, her experience is smooth, fast, and stress-free:

She messages her insurer: "Had an accident. Need help."

Within seconds, an AI chatbot responds, guiding her through the next steps.

Sarah snaps a few photos of the damage and sends them through the chat.

AI analyzes the images in real-time, providing an initial assessment.

A human agent jumps in, confirming the AI's assessment and initiating the claim process.

Sarah receives regular updates on her claim status, all through WhatsApp.

Deliver a Satisfying, Simplified Insurance Journey with WhatsApp

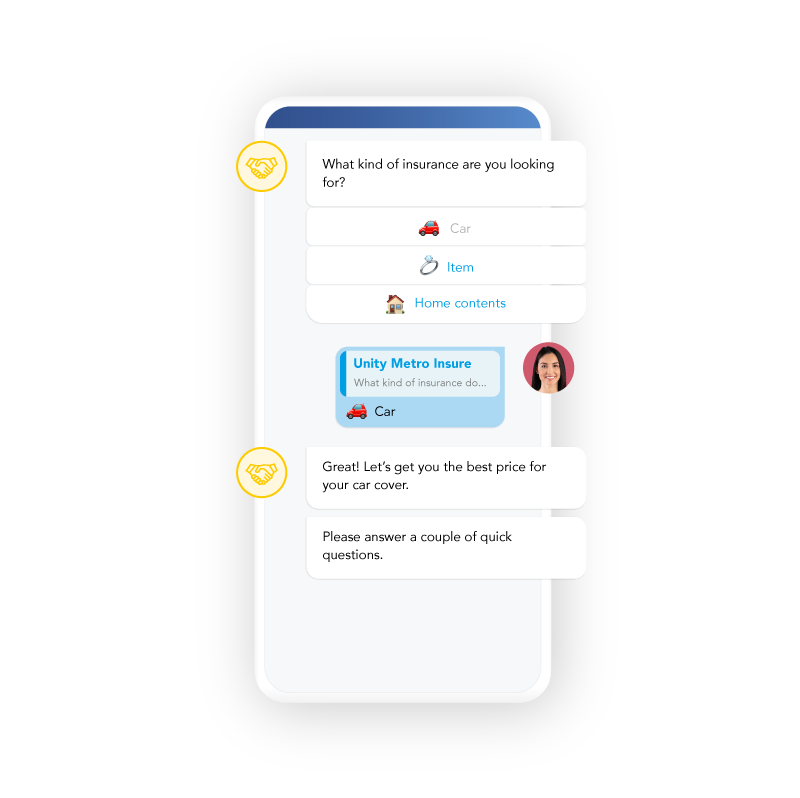

Generate Quick Quotes

Customers can receive personalized insurance quotes almost instantaneously by answering a few simple questions via chat. This efficiency not only saves time for both the company and the client but also provides a user-friendly experience that can lead to higher conversion rates.

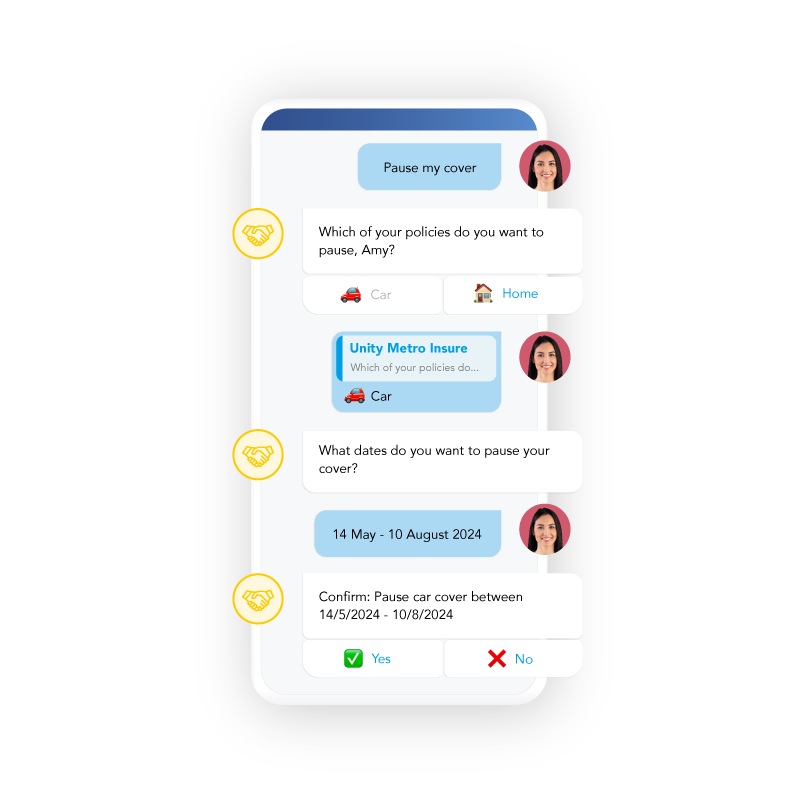

Simplify Policy Management

Insurers can send policy renewal reminders, premium payment notifications, and coverage updates in WhatsApp. Customers, in turn, can request policy changes or seek clarifications about their coverage quickly and conveniently. This self-service approach reduces the workload on customer service teams while providing clients with convenient, 24/7 access to their insurance information.

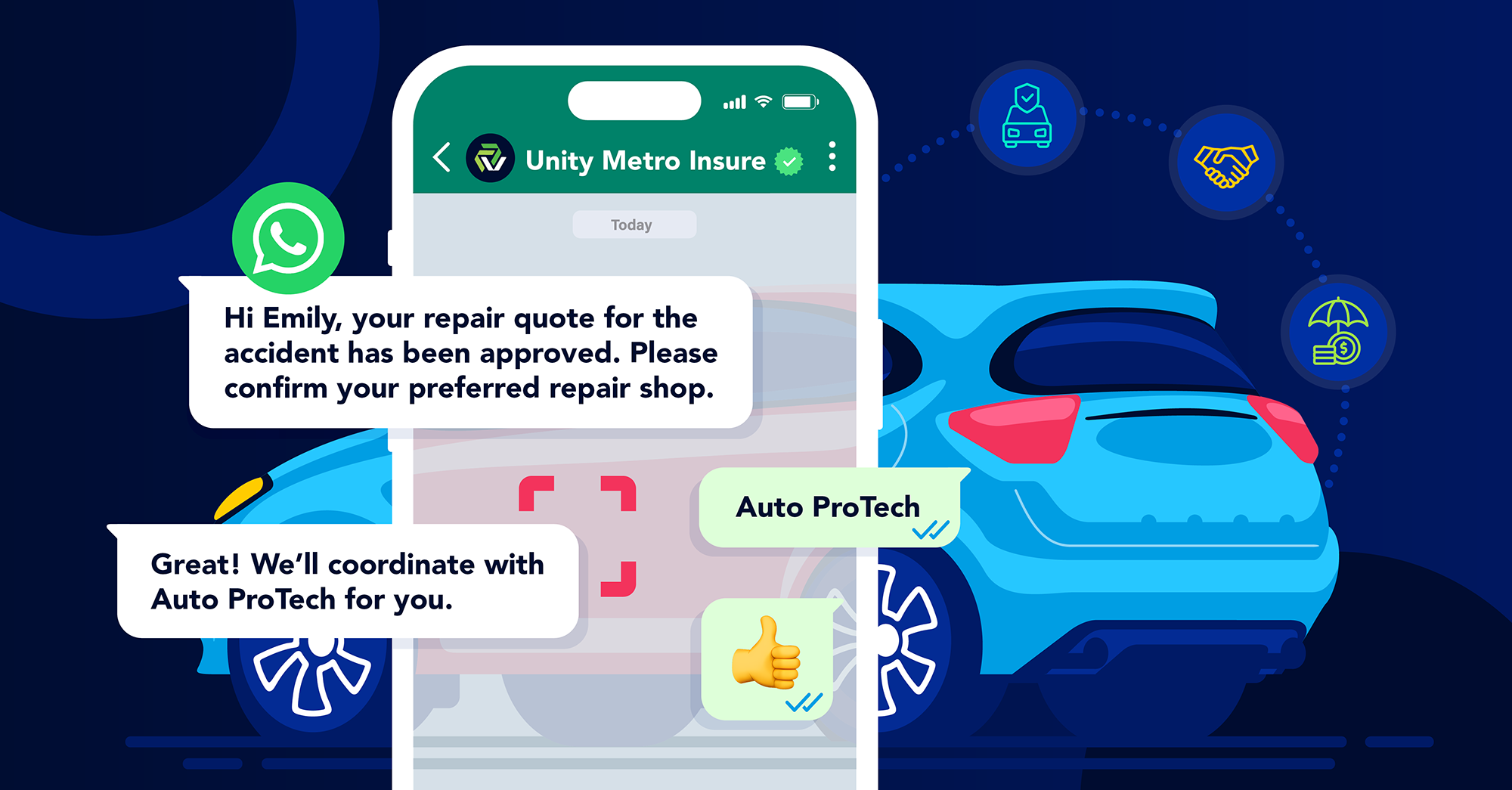

Streamline Claims Processing

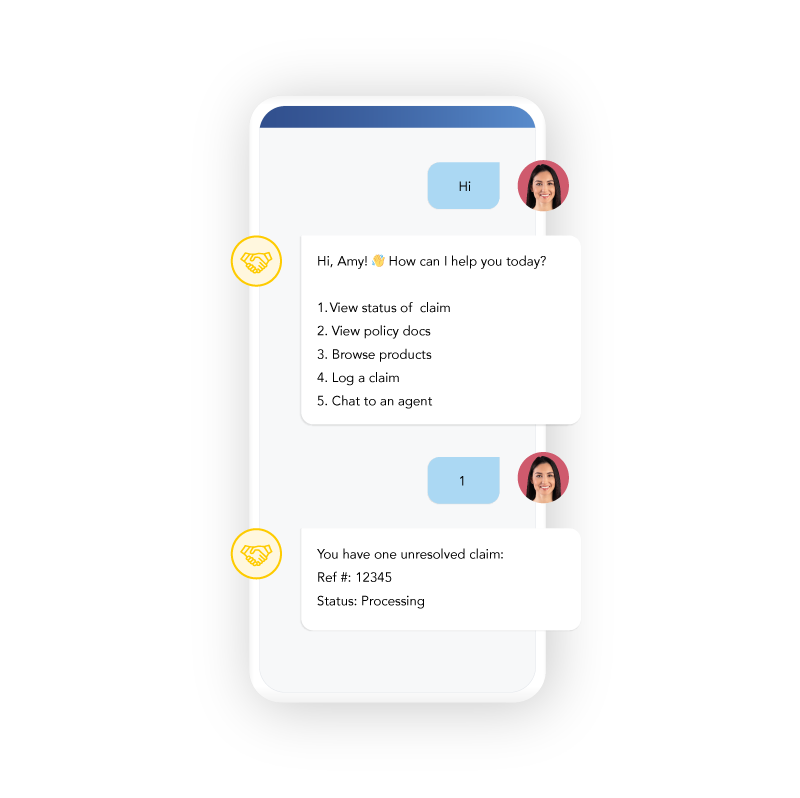

The claims process, often viewed as complex and time-consuming, can be significantly improved through WhatsApp and its multimedia capabilities. Customers can report claims immediately and send photos or videos of damage, accident scenes, or other relevant information and documents directly through WhatsApp. They can also track the status of their claims in real-time, increasing transparency, and leading to higher customer satisfaction.

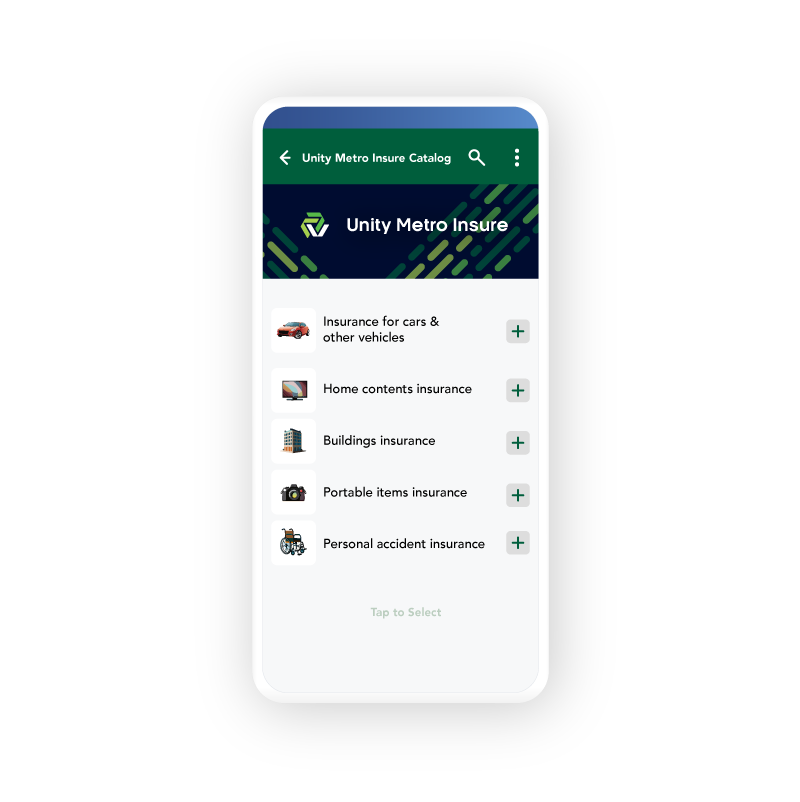

Purchase Products

WhatsApp can be an effective tool for marketing new insurance products or cross-selling to existing customers. Insurers can use the channel to share informative content, promotional offers, guide customers through various insurance products, answer queries, make personalized recommendations, and even facilitate the purchase process.

Support Customers

By utilizing WhatsApp as a customer service channel, insurance companies can reduce costs associated with traditional call centers. The platform allows for both instant automated responses to common queries via chatbots and personalized assistance from human agents for more complex issues. The transition from bot to agent happens in-channel, ensuring a seamless customer experience.

Deepen Customer Insights

Through WhatsApp interactions, businesses can gather valuable data about customer preferences, common issues, and frequently asked questions – information that can be used to pinpoint areas for development to improve products, services, and the overall customer experience.

Improve Communication

A direct, instant, and personal communication channel between insurers and their clients allows for quick information exchanges, whether answering queries, providing updates, or sharing important documents. This immediacy and transparency can greatly improve customer satisfaction and loyalty, and build stronger, more personal relationships.

Security and Compliance: We've Got You Covered

While the benefits of using WhatsApp for insurance services are clear, when dealing with sensitive insurance matters it's crucial to address data protection and privacy concerns. WhatsApp offers end-to-end encryption, ensuring that all communications between business and customer remain private and secure. Clickatell is committed to maintaining the stringent controls needed to ensure the confidentiality, integrity, and availability of all data in the system. Additionally, a robust authentication feature enables customers to log in and engage securely with services on internal platforms using existing credentials.

Insuring Tomorrow

Incorporating WhatsApp into insurance operations represents a significant step towards digital transformation and customer-centric service. It offers numerous benefits, including improved efficiency, enhanced customer experience, and potential cost savings. The key lies in thoughtful implementation that balances automation with personalized service, ensuring that the human touch remains an integral part of customer interactions.

As the insurance industry continues to evolve, leveraging such widely used communication platforms will likely become crucial for companies looking to stay competitive and meet the changing expectations of their customers.

Ready to Transform Your Insurance Offering?

Embrace WhatsApp and position your brand at the forefront of innovation. Talk to us to find out how.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.