“The opportunities in the payments ecosystem on the continent are promising. For example, Sub-Saharan Africa dominates the mobile money market, responsible for 70% of the $1 trillion mobile money transactions processed globally last year.” - Forbes

According to Statista, there are currently 6.648 billion smartphone users globally which equate to 83.32% of the world’s population. Considering how ubiquitous mobile phones are, it’s logical that these are being leveraged for business transactions. In Africa, mobile payments have become one of the leading forms of payment, and with developed countries having strong connectivity and technology resources, mobile payments will likely continue to grow over the coming years.

What is a mobile payment?

Mobile or text payments are a way for businesses to accept in-person customer payments via mobile messaging apps. Mobile payments let you accept card and mobile wallet payments on any mobile POS (point of sale), smartphones, or other devices. It’s a great way to make payments without any need for cards.

What are the challenges of card payments?

While mobile payments are dominating the African continent, and starting to gain traction in the United States, credit and debit card payments are still popular – for now. These traditional payment methods do come with some challenges though.

- Price

Many corporations and medium-sized merchants can accept card payments as they rely on the necessary POS terminal and associated technologies. However, these do come with a hefty price tag which often makes them unaffordable for smaller merchants.

- Payment delays

When paying with a card, there is typically a delay in payment settlement – of a day or so – which might work for bigger organizations, but not necessarily for smaller merchants who require daily funding to meet inventory needs.

What are the benefits of mobile payments?

Card payments have been the dominant payment method for many years, but there’s no doubt that they’re getting surpassed by text payments. Here’s why mobile payments are likely to be the preferred option in the US.

1. Easy to use

No matter how technologically limited a person is, it’s highly likely that they will have a mobile phone and are capable of using messaging apps. Text payment simply provides them with a way to make payments in the messaging apps they’re already familiar with.

2. Payment security

When it comes to engaging online, cybersecurity needs to be a top consideration. With text payments, you can be assured that both you and your customers’ data is kept safe and secure. Mobile payments use encrypted code to protect data, with no card numbers stored on the mobile payment equipment. There is also biometric authentication required for smartphones, making mobile payments even more secure.

3. Global reach

No matter what your business is, it’s likely that you’re going to want to extend your reach beyond local customers. With a mobile payment, you have global reach, especially as more and more consumers in the US start to adopt this payment method.

4. Instant payment

Unlike card payments, mobile payment doesn’t require you to have a POS terminal to collect funds, which is what can delay the transaction. This makes mobile payments much more likely to be instant, which is great news for small-to-medium-sized organizations that require daily cash flow. You’re getting your money from customers that much faster.

5. Confirmation

Mobile payment methods are now able to provide you and your customers with payment confirmation, settlement, and reconciliation services. This mitigates any risk associated with non-payment and provides you with the necessary data for your bookkeeping.

6. Affordability

Mobile payments are a much more affordable option than card payments as you’re not having to spend funds on expensive POS equipment, paper, ink, and associated maintenance. You can use a tablet or smartphone as your mobile POS device so there are massive cost savings.

7. Loyalty programmes

You can even adopt loyalty programmes when you introduce mobile payment methods for better customer experience and retention. Some of the loyalty programmes you might consider include:

Tiered loyalty programmes: This is where a set number of purchases provides your customers with a new tier of rewards or discounts.

Points loyalty programme: This is where your customers get points for each transaction which accumulate for discounts or a free product.

Hybrid loyalty programme: This is even more beneficial for customers whereby you combine both tiered and points loyalty programmes.

8. Customer data

Data is one of the most valuable assets for a modern business that utilizes a mobile payment option - you’re able to access customer-relevant data for future use. This does not include sensitive payment details, but rather your customer behaviour information – their average spend, location, and products they prefer - so that you can better tailor your offers, services, and more for a better customer experience.

Why is Chat 2 Pay an industry leader?

Clickatell’s Chat 2 Pay is considered one of the leading forms of mobile payments. Clickatell is a pioneer in the space with more than 20 years of messaging, engagement, and commerce experience. Some of the reasons Clickatell is a leader in text payments are:

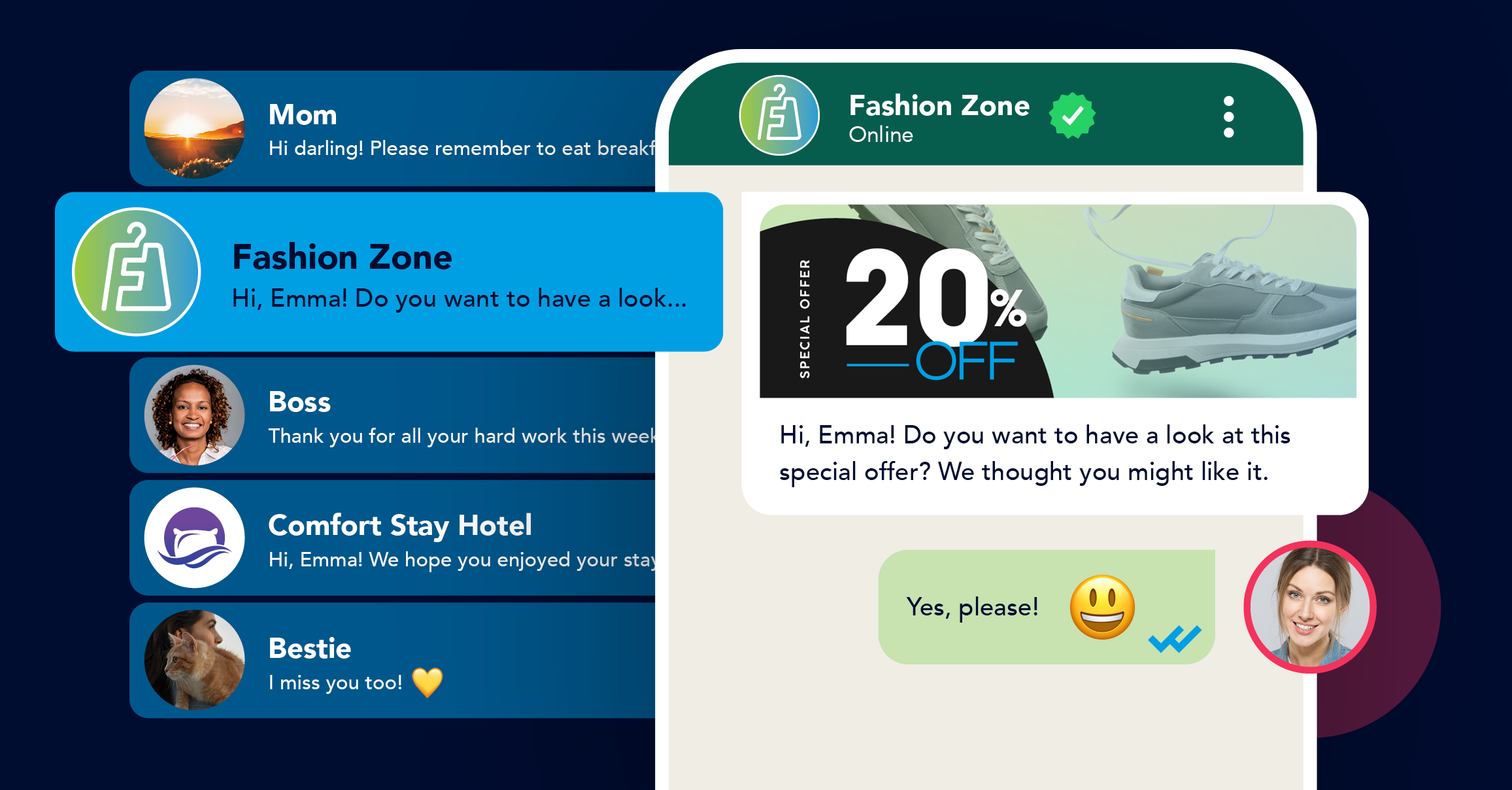

Popular channels: Chat 2 Pay facilitates mobile payments via WhatsApp and SMS.

Boost sales: You can use Chat 2 Pay to gather data for future cross- and up-selling opportunities.

Low operational costs: Because you’re not needing to spend on massive call centre costs, you’re saving in the long run.

Simple: Chat 2 Pay is a completely simple and easy way to make payments.

How Chat 2 Pay works

Chat 2 Pay is the mobile payment component of the Clickatell Chat Commerce platform that enables transactions via WhatsApp and SMS in 3 steps:

A payment request is triggered by a call centre agent from the customer’s order management system (OMS) and sent to the customer via a link on WhatsApp or SMS.

The customer receives and clicks on the secure link and is directed to a hosted checkout page.

The customer completes his/her details, submits the payment, and receives confirmation via chat.

Chat 2 Pay can then be implemented in several ways:

Chatbot messaging

Live agent messaging

Salesforce order management integration

Enterprise-grade APIs

Clickatell Chat 2 Pay forms part of the ever-growing Chat Commerce Platform that lets you engage with your customers efficiently and conveniently through chat along their commerce journey. From helping your customers discover products, place orders, and make payments, to tracking deliveries and providing after-sales support, Clickatell enables it all.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.