The insurance industry, long known for its traditional practices, is on the brink of a digital revolution. As technology advances and customer expectations change, insurers need to update their operations and customer interactions. Consumers now expect the same smooth digital experiences from their insurance providers that they enjoy in other areas of life. They want quick access to information, fast claim resolutions, and personalized services — all easily accessible. To stay competitive and meet these new demands, insurance companies must adopt digital innovation, rethinking how they operate and engage with customers in the digital landscape.

Digital Innovation in Insurance

Several areas within the insurance industry are already benefiting from digital transformation:

Telematics in Auto Insurance: Companies are using IoT devices to track driving behavior, offering personalized premiums based on actual driving habits.

AI in Underwriting: Machine learning algorithms are streamlining the underwriting process, making it faster and more accurate.

Blockchain for Fraud Detection: Some insurers are exploring blockchain technology to create tamper-proof records and reduce fraudulent claims.

Drone Technology for Claims Assessment: Drones are being used to assess property damage, especially in areas difficult for human adjusters to access.

Despite these advancements, many insurers still struggle to provide a cohesive, user-friendly digital experience that meets all customer needs in one place. This is where messaging platforms, particularly WhatsApp, enter the picture.

WhatsApp: The Perfect Fit for Insurance's Digital Transformation

With over 3 billion users worldwide, WhatsApp offers insurers the opportunity to connect with their customers where they already are. Unlike standalone apps that often suffer from low engagement, WhatsApp provides a familiar, always-on platform that customers use daily.

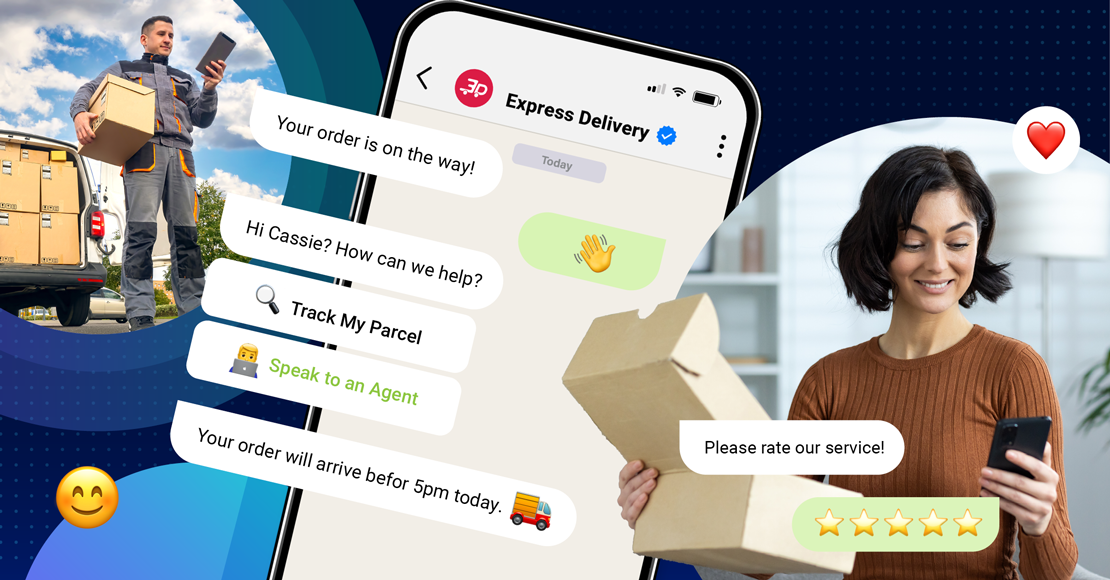

WhatsApp enables insurers to offer a range of services efficiently:

Quick Quotes: Customers can receive personalized insurance quotes by answering a few simple questions via chat.

Policy Management: Insurers can send policy renewal reminders, premium payment notifications, and coverage updates directly through WhatsApp.

Streamlined Claims Processing: Customers can report claims immediately, send photos or videos of damage, and track claim status in real-time.

Customer Support: WhatsApp allows for both automated responses to common queries and personalized assistance from human agents for complex issues.

Chatbots, AI, Data, and Analytics

The true potential of WhatsApp in insurance is realized through conversational experiences, powered by chatbots and live agents, and supported with generative AI to generate rich data points for sophisticated analytics. This powerful combination transforms customer interactions:

Chatbots handle routine queries efficiently, providing instant responses to common questions about policies, claims, or general insurance information. These AI-driven assistants can guide customers through simple processes, freeing up human agents for more complex tasks.

When needed, conversations seamlessly transition to live agents who can handle nuanced inquiries or sensitive situations, ensuring a personalized touch where it matters most.

AI algorithms work behind the scenes, analyzing images sent through WhatsApp for initial damage assessments in claims, speeding up the claims process and improving accuracy.

Every interaction generates valuable data points, which feed into sophisticated analytics systems. These systems can identify trends, predict customer needs, and inform product development, ultimately leading to more tailored insurance offerings and improved customer experiences.

As highlighted in EY's "Claims in a digital era" report, 87% of policyholders believe the claims experience impacts their decision to remain with insurers. This integration of conversational interfaces, AI, and data analytics not only enhances operational efficiency but also significantly improves the customer journey, making insurance processes more accessible, faster, and more personalized than ever before.

Integration with Other Technologies

The power of digital platforms like WhatsApp in insurance is amplified when integrated with other technologies, particularly CRM systems and back-end services. These integrations create a more cohesive and efficient customer experience, reducing friction points and enabling faster service delivery.

Personalization and Privacy

The wealth of data generated through digital interactions presents a significant opportunity for personalization. Insurers can use this data to tailor product recommendations, adjust communication styles, and provide proactive risk management advice.

However, this level of personalization must be balanced with privacy concerns. Insurers must be transparent about data usage and provide clear opt-in/opt-out options. Implementing robust data protection measures and adhering to regulations like GDPR are crucial to maintaining customer trust.

Conclusion

Digital transformation represents an opportunity for the industry to deliver more engaging, efficient, and personalized customer experiences. As customer expectations continue to evolve, insurers who embrace channels like WhatsApp will be well-positioned to survive and thrive. The future of insurance is digital, personal, and immediate. With the right channel strategy, that future is within reach. Insurers who seize this opportunity will not only meet the changing needs of their customers but will also set new standards for customer experience in the industry.

Ready to Transform Your Insurance Offering?

Embrace WhatsApp and position your brand at the forefront of innovation. Talk to us to find out how.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.