By Werner Lindemann, SVP-Commercial: Middle East & Southern Africa

According to PwC’s 23rd Annual Global CEO Survey, insurance companies are becoming more receptive to technological changes over time. And for good reason. Bifurcation of insurance options and channels has made it imperative for insurance companies to lead with technology and customer experience transformation to maintain an advantage over competitors and to continue to meet customers’ ever-evolving digital expectations for service and support.

Following are three ways insurance leaders can leverage new digital channels – including chat – to save money, improve efficiencies and better leverage technology to improve their customer experience.

Use chat to improve engagement and build trust

Connected consumers, and particularly Generation Y, want more electronic communications and resources from insurers, but many are not receiving it. It is important to reach policyholders through channels that are most convenient to each individual. Chat is already the preferred communication channel for more than 5 billion people around the world. WhatsApp has 2 billion monthly active users and is the leading messaging app in South Africa, Nigeria, Brazil, and India.

By its very nature, insurance is a complex industry. There are large numbers of products, a multitude of intermediaries, complex pricing and underwriting models, and insurance events that are often highly bespoke to the claimant. But chat can help simplify the customer experience by providing account management and chat communications services for FAQs and support to contact centers via chat for call deflection.

What if the consumer can get everything they want through engaging with a trusted entity in their address book through chat? A communications vehicle like this would do wonders to improve brand trust and satisfaction scores. By delivering claims communications or offering services to accept claims submissions through chat, insurers can directly connect to content repositories that provide both intelligent and interactive documents to agents and brokers. Then, agents and brokers can deliver the information to policyholders via smartphone chat channels, which will attract and acquire new customers, generate new revenue opportunities, reduce costs, and increase customer satisfaction.

Develop greater flexibility in offerings

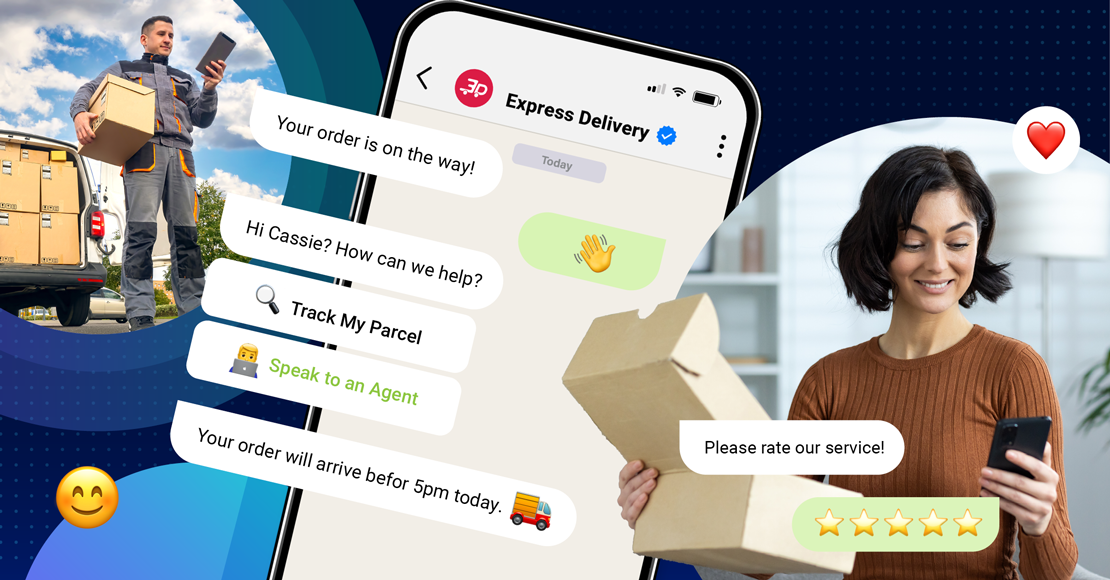

Time-flexible, event-driven, modular, and adjustable coverage may evolve to accommodate life stage, lifestyle, and wellness changes among consumers. Insurers can create automated chatbots to cater for this and adjust or add onto the insurance premium accordingly, or even make a payment in-channel.

Given the growth and shopping pattern changes in emerging markets, insurers who introduce flexible term products and master digital distribution without compromising underwriting are likely to win in the marketplace. Again, a good portion of this can be automated through unassisted chat environments, with contact centers even being supported via WhatsApp chat call deflection via Clickatell’s Chat Desk solution.

Supporting customer service with chat to drive efficiency and cost optimization

Customers want digital flexibility and support and service are areas that allow for increased digitalization and innovating that will help lower costs while also improving satisfaction scores and helping solve customer problems faster. Our new Chat Desk contact center solution provides companies with a new way to lower high volume contact center costs while providing superior customer support via chat.

We know that as much as 80 percent of incoming calls to a typical contact center involve questions or issues that have already been resolved – they are common questions with fairly easy solutions. However, each time this question must be posed to a live agent, it is costing time and money to solve and prevent more serious issues from being resolved by trained contact center staff. Our Chat Desk solution allows your business to use chat through WhatsApp to allow customers to quickly and easily get answers to these easy questions and free up your agents to deliver real value on the more difficult queries. Customers save time and see your business as innovating with new technologies, your contact center can reduce call volumes and wait time and call handoffs through complicated and frustrating IVR menus are taken out of the equation.

At Clickatell, we work every day to build products that help improve communications and engagement and deliver value to customers through new chat channels. We would welcome the opportunity to help your business take the next step on the path to the chat revolution.

Contact us today to learn more about how we can help!

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.