Every new advancement brings with it a new set of challenges, and in the case of the fourth industrial revolution (4IR), the challenge is cybercrime. With digital transactions ramped up amidst the global pandemic, businesses have seen a dramatic spike in various forms of cybercrime. According to IBM's Cost of Data Breach Report, the cost of data breaches rose from $3.86 million to $4.24 million worldwide in 2021 - the highest average total cost in the 17-year history of the data breach report.

To protect their consumers, ecommerce companies are implementing a range of cyber safety and security measures behind the scenes, as well as some that are more evident to the consumer. These include tiered verification methods, biometric authentication and even warning their customers through scam alerts. And one of the most impactful ways to warn customers of online fraud is via chat. Here’s a look at how this works.

What are the types of digital fraud?

To truly understand the need for such scam alerts sent via WhatsApp, it’s important to understand the extent of digital fraud. To give you an idea, here’s an overview of some of the more prevalent scams today.

Phishing: This is where fraudsters use an email to redirect customers to fake websites. Once here, they encourage the individual to disclose confidential information such as account numbers, passwords and other financial details.

Vishing: This is a similar scam to phishing, but it uses the telephone rather than email. A person or automated response system contacts the customer and encourages the sharing of personal information.

Hijacking: In this scam, the cyber-criminal pose as the user to gain access to private information.

Investment fraud: There are a really expansive range of investment fraud options whereby con artists make false promises about potential returns and benefits.

Malware and botnets: Once the scammer has gained access to a customer’s device, they can inject malicious software – malware – which enslaves the machine as part of a network of computers. This network of robot computers is referred to as a botnet. This allows the cyber-criminal to break through security features and access highly sensitive data.

Identity theft: There is a lot of personal information already online thanks to social media accounts, and this is often used maliciously to create identification such as driver’s licences and ID books.

How Scam Alerts are Sent via Chat

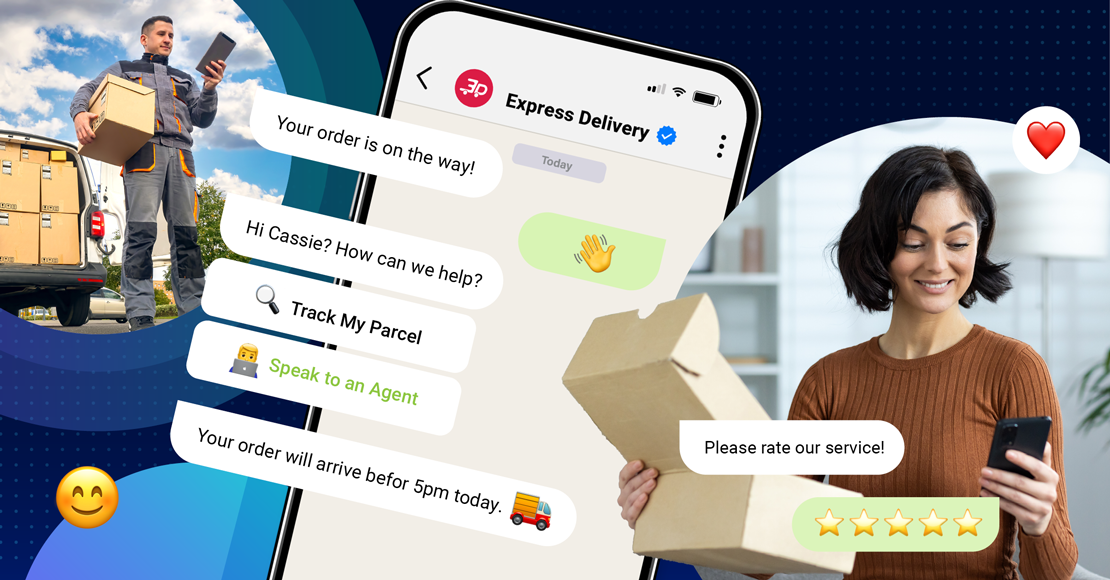

While the chat platforms are often used by fraudsters to scam customers because of the far-reaching nature of this communication system, these platforms can also be used to warn customers of a type of scam doing the rounds. Customers are then well aware of the potential risk when engaging in any transaction, and better prepared to respond.

Scam alerts are also incredibly useful when an unusual purchasing pattern is noted. A company can send a fraud notification via WhatsApp when a purchase is made outside the cardholder’s normal geographical location, when it’s made at an unusual time, or simply when it’s an irregular purchase. These notifications can also be sent when similar purchasing patterns match fraudulent trends.

Customers are immediately notified via chat when any purchase has been made via one of their payment channels, without the correct authority. This can result in a much quicker reaction time to halt the purchase and prevent any further fraudulent activity.

The Benefits of Chat for Fraud Alerts

The rise of social media interaction and prevalence of smart phones has quickly made chat platforms the preferred space for engaging with customers. Here’s why WhatsApp and other chat platforms are beneficial for sending scam alerts:

1. Response rate

While contact via telephone or email is certainly possible, contacting customers via chat platforms is often the preferred option. This is because chat gets a much higher response rate. In fact, Gartner reports that chat messages have an open rate of 98% - as opposed to 20% with email.

2. Real-time response

Because the chat platform is available on a smartphone, the customer is able to engage with your company in real-time. This immediate chat interaction speeds up the response and resolution of fraud inquiries.

3. Cost-effective

Chat, as opposed to telephone calls or SMS, is a substantially cheaper form of communication with your customers, particularly when they’re travelling internationally.

4. Security features

Chat platforms like WhatsApp have superior inbuilt security features that minimize the risk to customers. Businesses using the platform will need to be verified and this makes impersonation of legitimate organizations much tougher. There’s also end-to-end encryption, multi-factor authentication and other privacy measures.

5. Machine Learning (ML)

Chat platforms rely on ML in processes which makes them incredibly useful in verifying users. The access to data means companies have a better understanding of their customers, including their purchasing behaviour.

6. Deals with higher volumes

There were more than 1.5 million coronavirus-themed fraud emails from mid-January to mid-April. This resulted in a massive spike in call center communication, making it difficult to deal with all customer queries timeously and effectively. However, using a chat platform, businesses can get through high volumes at a much faster pace.

Clickatell Can Protect You with Scam Alerts

As a leader in chat commerce, Clickatell is able to effectively protect your business through fraud alerts via secure chat apps. The benefits of Clickatell’s scam alerts via chat include:

Response time: Clickatell’s messages have up to 90% open rates with the average response time of under a minute.

Scalability: Clickatell’s chat solutions are suited to all businesses from small through to massive credit unions, governments and emergency responders. Clickatell powers and delivers up to 10 billion messages annually for 75 industry leading financial institutions.

Security: For more than two decades, Clickatell has been providing secure engagement, transactional and communication solutions. These modern chat solutions have multi-factor authentication, privacy and end-to-end encryption.

Get int touch with Clickatell to find out more about our safe and secure chat commerce solutions.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.