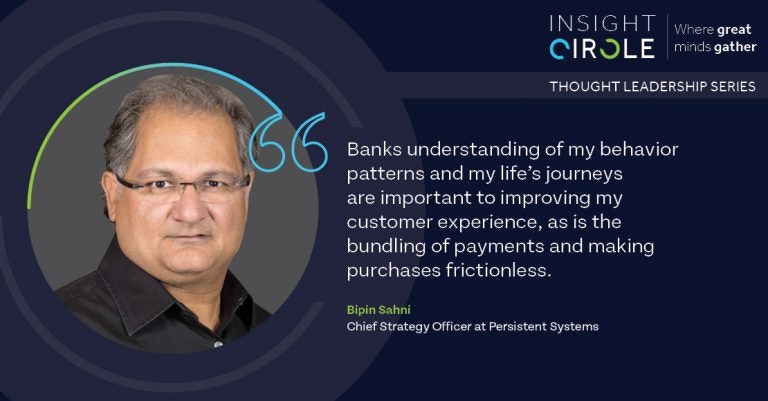

How do banks envision the future and build core competencies to deliver next generation business models centered on changing consumer behaviors? This was a subject we discussed with our most recent guest in the Insight Circle series, Bipin Sahni, Chief Strategy Officer at Persistent Systems, a global solutions company delivering digital business acceleration, enterprise modernization, and digital engineering.

Bipin started out his career as a junior programmer at Wells Fargo where he would eventually spend close to 25 years.

Bipin transitioned through multiple roles and grew up from being a developer to a database administrator to, being responsible for Innovation and running mergers. Bipin shared that “The Wachovia - Wells Fargo merger was one of the key highlights of my career because it was bringing two of the biggest US banks together…”

Bipin continued about his experiences at Wells Fargo “…they kept giving me opportunities to do and learn new things including the opportunity to be a part of a team that created a flagship product from Wells Fargo called the Commercial Electronic Office”.

Later in his career, Bipin joined The Innovation Group at Wells Fargo where he was responsible for innovation in the research and development of new business models and concepts. This involved investing in and partnering with, Fintech startups so that Wells Fargo could bring greater value to its customers.

This is where Bipin’s transition to Chief Strategy Officer connects to his experiences at Wells Fargo. Bipin said that he had selected and worked with Persistent Systems while at Wells Fargo and that interaction led to his new role. Bipin indicated that Persistent Systems is a systems integrator with a vertical focus along with horizontals (Data, Salesforce, Cloud, Security, IBA and core application modernization) supporting the BFSI vertical. They have worked with challenger banks, and smaller regional banks and have applied what they learned there in digital banking. Part of that engagement with the market involves working with Fintechs again.

One of the lessons Bipin shared is when it comes to banking and any other industry undergoing transformation that it is better to partner with everybody so that you build an ecosystem. This applies to the banking industry and any other where there are challengers and established players. If your goals are to construct the optimal customer experience with innovative new services, it benefits all players to partner and collaborate. The challenge for many of the bigger banks according to Bipin is that they have a lot of data and have not taken full advantage of it. While the big banks have been focused on preventing fraud, they have not been able to develop and act on the insights they should be getting. This led us to ask Bipin to summarize the current challenges for large US banks.

“Leveraging data for insights and making those insights actionable is one area for banks to improve. Second is to be better at lending. Their understanding of my behavior patterns, my life's journeys, are important to improving my customer experience”.

Bipin then said that the bundling of payments and making purchases frictionless is also important.

We asked Bipin to expand on what Persistent Systems was doing to improve digital transformation in banking. Bipin shared information on a variety of initiatives that Persistent was pursuing to improve financial services. From blockchain infrastructure efforts to effect real-time information sharing between banks and vendors to creating the ability to transfer credit profiles internationally.

We then asked Bipin to comment on the US financial and banking system versus the world and what challenges and opportunities the US faced.

Bipin stated, “I was lucky enough to spend time with some leadership at the White House in relation to innovation programs and this topic was discussed”.

Bipin feels that “regulators have been more actively involved in the US and that has been a key stumbling block for the US economy. The adoption of mobile was a little slower overall in the US versus China or India for example. The ability to authenticate your identity from your phone and facilitate the rapid development of digital payment ecosystems has been hampered. Google and Facebook are doing a lot more stuff in India than they're doing here. I think it's just going to take some time for the US economy to recognize and implement digital currencies and/ or the digital method of accepting payments”.

Given Bipin’s incredible success we asked him to offer advice for the younger generations. He started with “I'm a big fan of Elon Musk, what he's trying to do and what he's done already, the way he disrupted multiple industries and he's always up to something else. I think there's so much to learn from some of these key leaders who are actually defining how the world will be in the future”.

Bipin then shared some specific advice with us for those early in their careers. “…don't be running after the money. You have to absorb and learn; learning can never stop even now where I am in my career. You stop learning, you stop growing. Try to be a leader at some point in your life. Don’t always be a follower. So much is going to change and be automated that you can’t sit still and wait for it”.

Some powerful words of advice from Bipin to close off an interesting and informative interview.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.