The banking space has shifted significantly the past few years, precipitated by the forced social distancing measures during the pandemic. With more customers dealing in digital financial transactions, banks have had to adapt and find the best way to connect with customers and facilitate online transactions through their preferred device. Live chat, in the form of WhatsApp or other messaging services, has created an enhanced customer journey when it comes to banking. Here’s how.

What is banking through chat?

Using your preferred chat app, you can now connect directly with your bank on a safe and secure digital channel. This allows you to perform a wide range of banking functions from your mobile phone, laptop or tablet – which we’ll outline below.

What is customer experience in banking?

The customer experience (CX) is the customer’s interaction with various touchpoints along the banking system. These include the online banking system, chat, emails, call centres, advertising and finally, face-to-face interactions. Customer experience is absolutely vital to the success of a business, and it’s never too soon to address this – even if you’re a popular brand. A PwC survey found that, in the United States, 59% of customers will walk away from a brand they trust after several bad experiences, with 17% walking away after just one bad experience. This is why improving your customers’ banking journey with chat is important now.

How does chat improve the customer experience in banking?

Here are some of the ways that chat can bring your customers much closer to your bank.

1. Provides 24/7, Constant Customer Support

No matter the time of day, your customers want to feel supported as soon as they reach out to you. Operating a 24-hour call centre for this is not only difficult, it’s also costly. When you introduce chat to your banking system, your customers are benefitting from immediate support. Chat can also integrate various communication platforms in one place, creating an omnichannel presence. This means that, no matter which platform they use, chat provides instant support.

2. Real-time Notifications

With fraud one of the biggest concerns in terms of financial transactions, customers want to know everything that is happening with their bank accounts at any time. This is where chat notifications are so helpful. Using this platform, banks can notify customers when they’ve performed a transaction, reached a budgetary limit, received payments, and more – all in real-time.

3. Financial Information

Chat can actually improve your customers’ banking experience by providing incredible financial insight through this channel. This includes financial advice on where to invest your money, the latest trends in banking and clarifying confusing banking terminology.

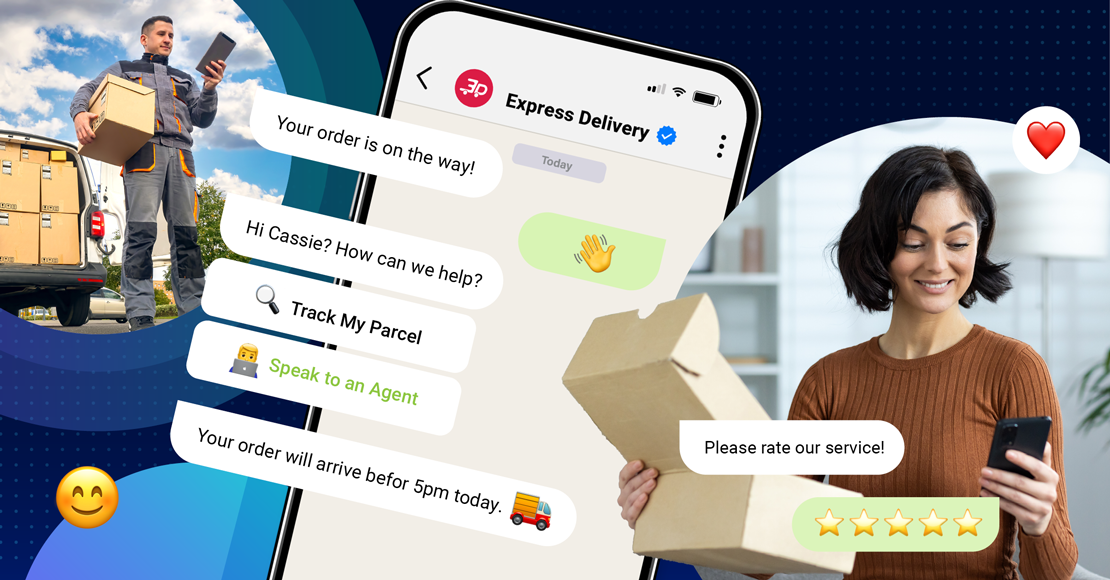

4. Easily Upload Documents

Many financial transactions require supporting documentation. Rather than having to visit a physical bank and wait in line, customers can now upload their documents, safely, using the chat platform. These documents are then verified in real-time, with confirmation sent and appointments scheduled if necessary.

5. Frequently Asked Questions (FAQs)

Because banking and finance has a variety of complex terminology and functions, customers often require quite a big of clarity. Nobody wants to go through with any deal involving money if they’re not sure what it all means. Fortunately, the chat platform provides customers with all the answers to their questions through a self-service feature. Whether they’re looking to apply for a loan, invest funds, open an account or check their bank balance, customers can be assisted via chat. Banks that use machine learning (ML) algorithms improve the customer experience as the AI-powered chat trains itself to provide better service each time.

6. Personalized Banking

Today’s customer requires more personalised services to develop brand trust and loyalty. Banks can achieve this personalization through chatbots which communicate with the customer. Using the data collected through customer feedback and surveys, banks can then provide a more tailored communication approach that suggests certain products or features that meet the individual customer’s needs. Chatbots can also assist by pre-populating fields on application forms to better facilitate processes. Banks that use machine learning (ML) algorithms improve the customer experience to provide better service each time.

7. Basic Banking Needs

While modern banks perform many activities, there are core banking functions that can actually be facilitated through chat. Transferring of funds, invoice payments, applications for loans or bonds – all of these can be done using the chat platform.

8. Build Brand Loyalty

Because of all the seamless and convenient chat functions and benefits, customers are enjoying a more enhanced banking journey. Using a channel like WhatsApp is also familiar to the customer, so they feel secure when interacting with the bank on this preferred platform. The result of this improved customer experience is better customer acquisition, conversion, retention and brand loyalty.

Why use Clickatell?

As a leading chat commerce provider, Clickatell can provide banks with the best chat platform to modernize the way their consumers do banking. This includes chat self-service in banking; account management in chat banking; and transaction services in chat banking. With Clickatell, bank customers can easily:

Get real-time support and rapid responses to inquiries.

Report fraud or ID theft, as well as the ability to turn cards on or off.

Find nearby banks or ATMs.

Apply for credit cards, loans, and other banking services.

View account balances.

Retrieve bank statements and tax documents.

Stop payments on checks.

Add or change overdraft services.

Open new accounts.

Set up and manage direct deposits.

Make instant payments and purchase mobile data and airtime, digital media subscriptions, and gift cards.

Manage digital products and payments, and purchase goods and services from your bank and partners.

Don’t let an outdated and impersonal platform impact your brand’s image. Get in touch with Clickatell today and improve your customers’ banking journey through chat.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.