Unity Metro Bank, a pioneering financial institution in Africa, has successfully launched an industry-disrupting digital wallet service via WhatsApp Business Platform, significantly enhancing financial inclusivity across the region. This innovative approach leverages the widespread use of WhatsApp to simplify banking services, making them accessible to a broader audience, including traditionally underserved communities.

The Company

Unity Metro Bank

Unity Metro Bank*, with a presence in over 10 countries, is known for delivering innovative digital financial services while driving financial inclusion. The bank’s collaboration with Clickatell has been instrumental in developing exciting and accessible financial solutions that cater to the needs of diverse populations.

Company size: 25,000+ employees

Location: Global

Products used: WhatsApp, Chat Flow, Chat Desk

The Challenge

Traditional Banking Limitations

A significant segment of the South African population still struggles to access essential financial services, including being able to afford and maintain a bank account, being able to receive and save money securely, to make and manage payments, and to pay bills.

Despite various interventions aimed at ensuring better access to these services, to “bank the unbanked”, many challenges remain, including salaries below the minimum income requirements, monthly fees, transportation costs to visit banks, the lack of physical banks in remote areas, and even the cost of the data required to download the banking app. Unity Metro Bank recognized these issues and committed to creating a retail banking solution that advances its digital transformation strategy, disrupts the Retail Banking industry, and helps integrate the unbanked into the financial system.

The Solution

A Sophisticated WhatsApp Banking Service that Delivers Digital Transformation and Fosters Financial Inclusivity

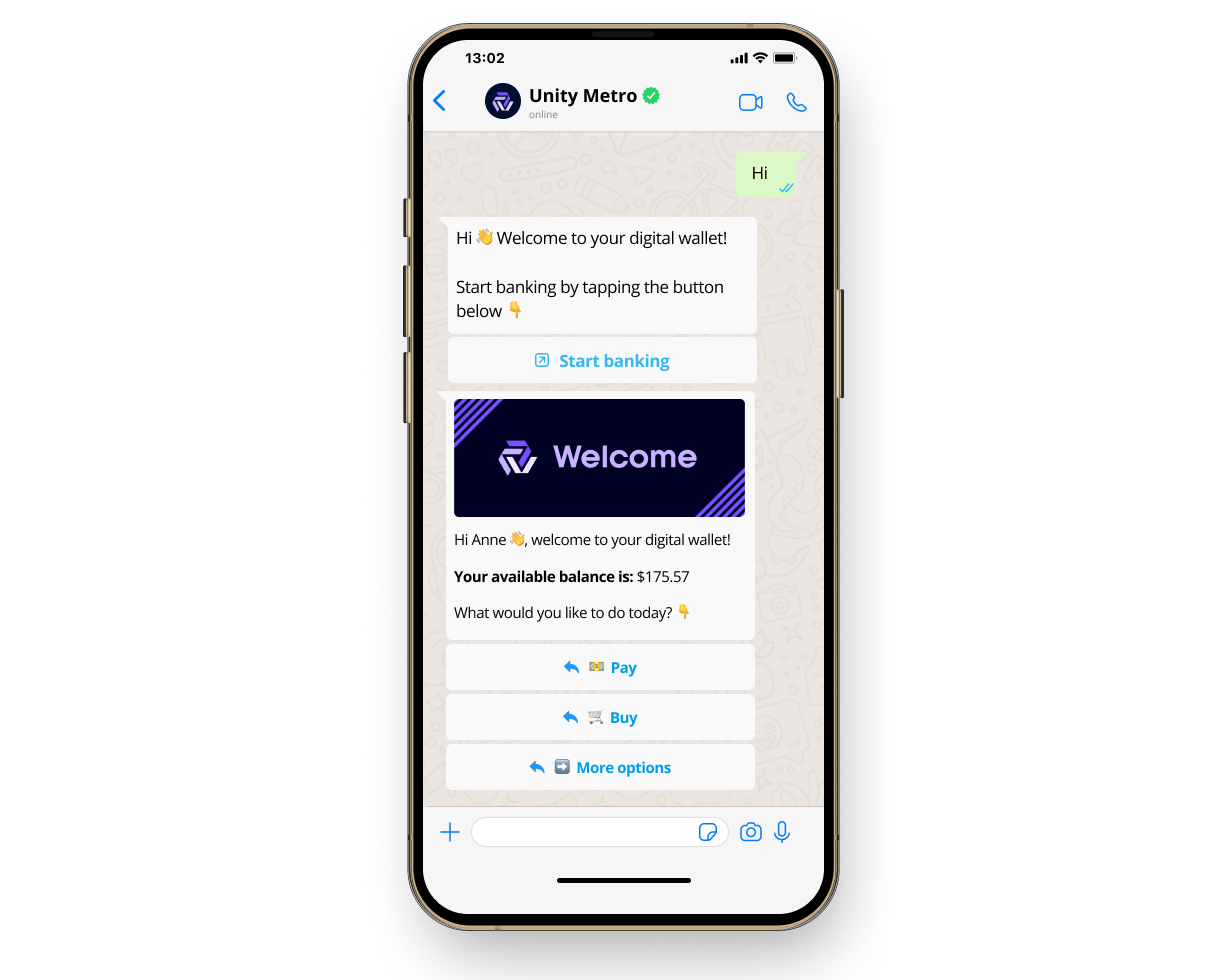

In partnership with Clickatell, Unity Metro Bank designed and launched a sophisticated, secure digital banking service on WhatsApp - a free bank account in the form of a digital wallet that includes functions like money transfers, bill payments, and airtime purchases, significantly simplifying financial engagements for users. The entire experience is delivered through messaging, from onboarding and account opening to adding a beneficiary and making payments. This does away with the need for a mobile banking app or a visit to the physical bank to create a banking profile in person. Users simply need to be over 18, have a smartphone linked to WhatsApp, and possess a valid national identity document for verification during onboarding. It is not necessary to have an existing traditional bank account, with Unity Metro, as the digital wallet is available to both existing customers and non-customers.

Technology Integration: Built with an API-first architecture to expose the backend functionality, the digital wallet also utilizes advanced AI technologies and natural language understanding (NLU) to determine user intent, and simplify user interactions, making the banking experience as intuitive as chatting with a human assistant. Facial recognition and liveness detection, along with ID document verification ensure that new customers are onboarded easily. These technologies enhance security and convenience, ensuring a seamless and secure user experience.

Customer-Centric Features: The digital wallet allows users to receive and save money, conduct P2P (person-to-person) payments, withdraw money from the wallet at an ATM, purchase airtime, data, and electricity, and get customer support. All this is enabled remotely through the familiar WhatsApp interface, while still being compliant with KYC, through robust identity verification and liveness detection, and the secure creation of a PIN code to access the account.

Impact and Reach: The initiative has proved to be a success, with rapid adoption of the service and use of the appropriate features, helping Unity Metro Bank increase reach, innovate with convenient technology and have a material impact on financial inclusion. Almost 94% of internet users in South Africa report using WhatsApp every month (see WhatsApp monthly usage in selected markets Q3 2023). This widespread adoption has allowed Unity Metro Bank to drive digital disruption while bridging the gap between financial services and underserved populations effectively.

The Power of Innovation

Unity Metro Bank’s WhatsApp digital wallet is a testament to the power of innovative digital solutions in overcoming traditional barriers to financial inclusion. Unity Metro Bank is in the process of expanding the offering to include microloans, investments and insurance, to offer further opportunities for economic empowerment and growth. By leveraging popular technology platforms and integrating advanced security features, Unity Metro Bank has positioned itself at the forefront of banking innovation, shaking up the industry vertical and ensuring that more individuals can participate successfully in the digital economy.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.