Businesses in any industry need to change with the times – and that's very evident in the digital age, when technology always seems to be advancing by leaps and bounds. One of the primary ways that we apply technology in business is in communications. Executives and leaders of all types hear people talking about things like user experience and customer engagement, and it makes them think about how these principles work in their particular fields.

In banking and FinTech, modernizing communications is essential for competing in a market where these businesses are serving depositors and borrowers, or anyone dealing with sensitive financials.

With that, it's important to meet busy customers where they are, and that means pivoting with changing preferences and communications.

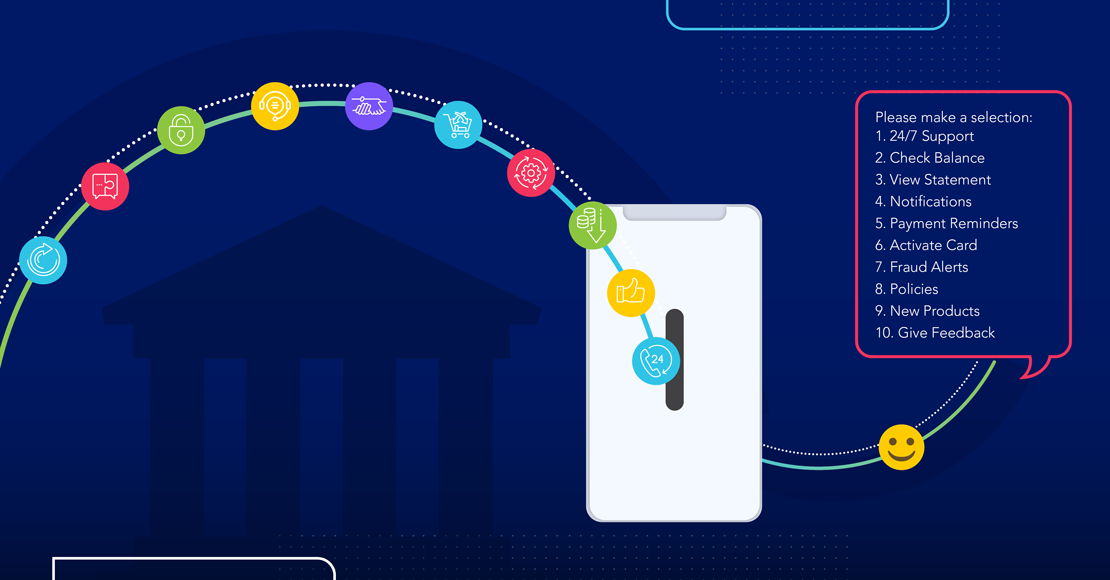

It wasn't so long ago that online banking was new. The idea of being able to pull up your account and look through all of your charges online, at home, without a printed statement, was revolutionary. But all banks had to quickly adapt to the reality that online banking is now a necessary part of the industry. Nowadays, customers expect you to offer them the convenience of support delivered straight to them around:

Card activations and authentication

Fraud Alerts

Balance information, payment reminders and transaction notifications

New service offerings and policy changes

All of which are available through 24/7 customer support!

Which is why there's one type of electronic communication that's taking the banking world by storm right now - two-way advanced messaging. Two- way messaging allows you to interact and transact directly through the channels that your customers already know and love, such as SMS and WhatsApp.

Here are the Top 10 Benefits of using Two-Way Messaging for Banks or FinTech:

1. 24/7 customer support

Two-way messaging, unlike a call center or branch, is open all the time. Depositors or borrowers can plug in information in the middle of the night if they want to know something and get a live response from an automated system that goes right to their smartphone.

2. Strengthening brand loyalty and customer satisfaction

As it was with online banking, messaging helps a bank attract and retain customers. If only one of five banks has this kind of messaging system in place, customers of the other banks are likely to jump ship and use the business that offers them this level of convenience and satisfaction.

3. Higher ROI and productivity

The automated use of two-way messaging is also a labor-saving adoption for banking businesses. One reason that banks are doing away with personal teller transactions is that they're so expensive. By contrast, messaging systems cost a small fraction of that to operate and allow banking businesses to scale.

4. Streamline internal operations by automating repetitive inquiries

Two-way advanced messaging that's automated can also create vast efficiencies in how banks deliver information to individual customers. For example, think about the number of people who make an account balance request every day. It wasn't too long ago that banks were caught trying to respond to every single request individually, which takes a massive amount of time and effort. That's another way that messaging is generating enormous ROI for banks.

5. Increase cross-sell and upsell

Along with the efficiencies that we mentioned above, the ability to cross-sell and upsell to customers should not be overlooked. Because advanced messaging is so much of an 'intimate' way to communicate – because the average smartphone user is used to using messaging for personal and direct communications, it can be much more effective than something like a password-protected dashboard or even a call center marketing campaign. It captures people's attention in a way that other channels can't, and so it offers banks the ability to increase customer spend more organically.

6. Create personalized interactions with customers

Decades ago, we thought of personalized customer interactions as a sort of science fiction phenomenon. People envisioned holograms speaking to us as individuals and calling us by name. We don't have that yet, but we do have two-way messaging that acts as a message delivered individually to you as a person. So that gives banks all kinds of abilities to talk to customers in a more personalized way, as mentioned above.

7. Ability to take increased volume of incoming inquiries with automation

Here's one way that banking leaders have probably been able to get buy-in for messaging systems. They simply explain that conventional systems can overload servers and make bank software crash. Automated two-way messaging systems are much more capable and resilient, given a lot of individual requests and demands on the system.

8. Extra layer of security

Another major and interesting value proposition for messaging in banking businesses. It has to do with the security of customer information. Across the security world, experts know that something called multifactor authentication is extremely powerful in preventing all kinds of hacking and unauthorized access to digital accounts and digital data. That's because MFA creates a system where someone verifies an initial interaction with a code that they could not have gotten unless they are the legitimate user who is ostensibly making a request.

By simply sending a verification code through messaging, banks can install MFA in all sorts of important communications. That will create its own value for the company in question.

9. Higher customer engagement

Two-way messaging being such a closely monitored form of communication, everything gets more personalized in these types of platforms. A message on a customers’ preferred channel feels not only more personalized, but also more familiar. It’s as if they’re getting a message from a friend. This causes consumers to feel more comfortable with a brand and become more engaged with the business.

10. Faster communication for time-sensitive updates

This one is important, too. For example, think about the manual process banks have used to notify customers of overdrafts or fraud alerts. It's simply inefficient and burdensome. Getting a postcard in the mail just doesn't cut it anymore.

Two-Way Advanced Messaging: The Modern Way of Banking

Real-time messaging is changing the game, cutting out a lot of the back and forth in important time-sensitive customer communications. Two-way advanced messaging curates more engaging, meaningful, and innovative interactions. Talk to a Clickatell expert to learn more about revolutionizing your business and the way that you engage with customers.

Step into the future of business messaging.

SMS and two-way channels, automation, call center integration, payments - do it all with Clickatell's Chat Commerce platform.